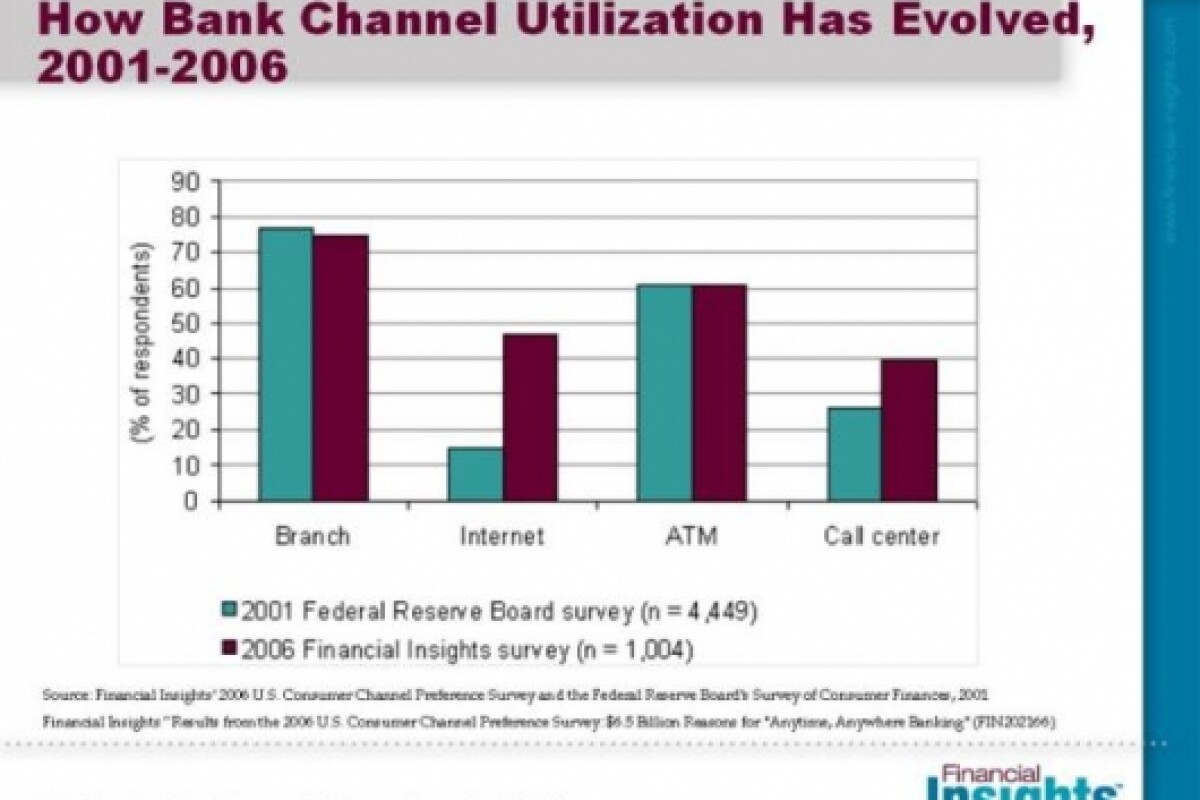

July 26, 2006 A picture might be worth 1000 words but a nice chart can tell a hell of a story and this one clearly illustrates how the channel utilization of banks has evolved over the past five years. Financial Insights has released a report examining the way in which customers interact with their banks. Comparing 2001 and 2006 survey data the findings show minimal changes in branch and ATM use and call centre and Internet channels enjoyed significant growth.

In the report, entitled "Results from the 2006 U.S. Consumer Channel Preference Survey: $6.5 Billion Reasons for "Anytime, Anywhere Banking", Karen Massey, senior research analyst and author, points out that for financial institutions, knowledge of how often and why consumers choose a certain touch point is invaluable in defining channel strategies and allocating IT resources.

Massey goes on to say, "Understanding the dynamics of channel utilization is critical for financial institutions and important as well for the vendors that serve the industry. Simply put, consumers want their banks to offer convenient, secure access, and they want their bank to know who they are. U. S. financial institutions plan to spend $6.5 billion on retail delivery channel technology in 2006, and banks that understand how consumers behave can maximize their investments and compete more effectively.

"Consumers expect that their institution has a 360-degree view of the financial relationship and real-time transactional history. The future of an integrated customer view and cross-channel strategy is core technology to support individually priced products and bundled services. The ability to present customized offerings to consumers will bring retail channel delivery into the next decade."