With credit cards and digital wallets on smart devices it's easier than ever to go cashless. But there's one group that still relies on the cash economy – kids. To make it easier for parents who struggle to come up with the cash when chores are completed or allowance time rolls around, New York-based Current has released an app-controlled Visa debit card designed to make it easy to give children some money and teach them good saving habits in the process.

Current looks and operates like a regular debit card, but the associated app grants parents a lot more control over their child's spending. To start with, parents are able to set up a recurring allowance transfer to their child's Current account, or send one-time payment for completing certain chores. All these transactions are recorded.

Once there's money in the account, the child is able to use it like a regular Visa debit card. If there are certain things the parent doesn't want their kid spending money on – alcohol or gambling, for example – they can use the app to block spending on that specific thing. The card can also be locked remotely.

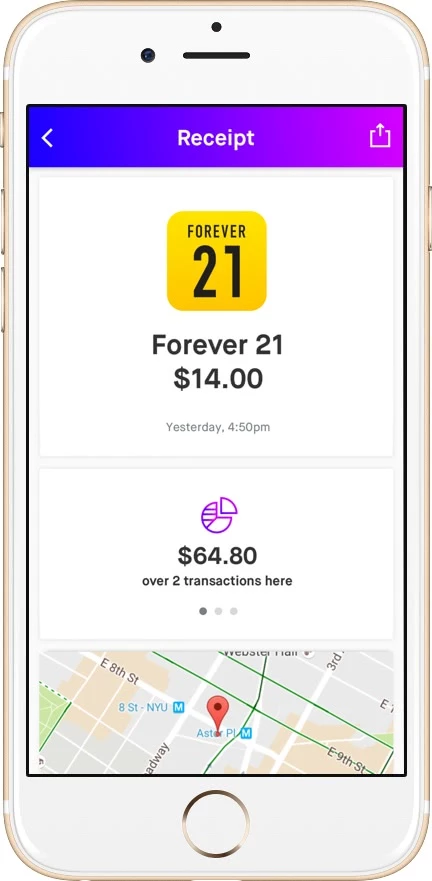

Both parents and children are able to keep track of purchases made with the card, and there are options within the app designed to encourage saving. For example, the card can be set up to round up every purchase and put the extra into a savings account. That means if something costs $7.55, the card will deduct $8 and put 45 cents into the savings account.

You'll pay US$5 per month to use Current. If you're confident the app is a good idea, you can also pay $36 upfront for a year or $48 upfront for two years.

Source: Current