The world's second-largest cryptocurrency is poised on the brink of a transformational overhaul. Within hours, "the merge" will happen, and the Ethereum network will eliminate 99.95% of its monstrous ~78 terawatt-hours per year energy consumption.

Cryptocurrencies like Bitcoin and Ether are not run by any bank or government. There is no central authority to decide whether a given transaction is legitimate or fraudulent – instead, the task of validating transactions and recording a traceable history for every unit of this electronic money is decentralized. In order for decentralization to work, validators need to be trusted that they're doing their job honestly and faithfully. And in order to be trusted, these people need to have some skin in the game, something to lose if they're caught cheating.

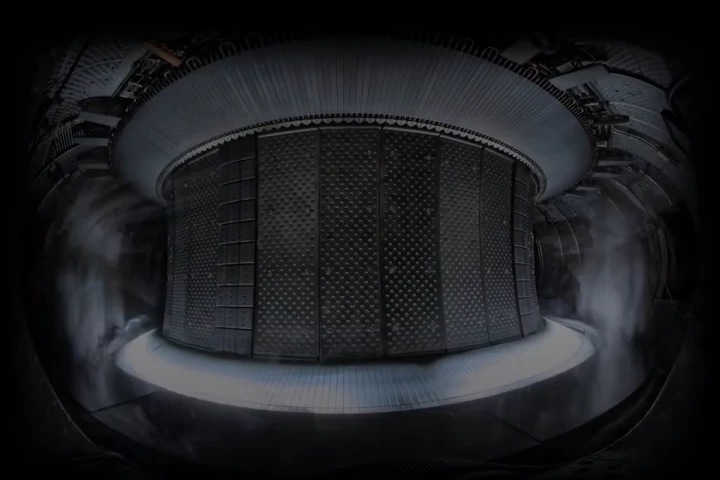

"The merge" – just hours away at the time of writing – is widely viewed as one of the biggest moments in crypto history. Ethereum is set to move away from its "proof of work" trust model, in which its blockchain validates transactions and ownership through the "work" of crypto-miners running exorbitant amounts of electricity through stacked banks of graphics cards, earning ETH currency in the process. This "work" – a series of very complex but ultimately useless calculations – proves that the miners have invested capital into their position as network validators. It's their skin in the game, money they put up to prove they're trustworthy.

The new model is known as "proof of stake." Under this model, anyone who stakes a minimum of 32 Ether tokens (valued at a little over US$50,000 at current rates) can become a validator. For each transaction, a group of validators are selected to perform a far less energy-intensive version of the mining process, and a consensus is reached. Any validator found to be acting dishonestly or doing the job incorrectly can have their staked Ether confiscated as a punishment – so there's still a considerable financial incentive to play by the book.

Switching over to the new model is an extremely complex and potentially risky move. The Ethereum network is decentralized, so it's not as simple as updating the software on a single data center. But the switch to proof-of-stake has been planned since the inception of the network, and since late 2020, a "beacon chain" proof-of-stake network has been running alongside the main Ethereum blockchain, intensively testing the new model. When "the merge" happens, the network will hot-swap over to the beacon chain for validation, and in theory, nothing will have to stop or be disrupted.

There are implications for security, for decentralization and for the future functionality of the Ethereum blockchain, which is set to expand in a series of subsequent upgrades referred to as "the surge," "the purge," "the verge" and "the splurge." And there are certainly risks – a move of this magnitude from a cryptocurrency of this scale (the entire network is worth nearly US$200 billion at this point) is unprecedented. Nobody really knows what this will do to the value of ETH, or what this will do to the crypto space as a whole.

But one thing does appear certain: the tap is about to be turned off on an unholy waste of energy that's objectively terrible for the planet. Whatever else you might think about cryptocurrencies, putting 78 terawatt-hours a year through piping hot banks of GPUs for no practically useful purpose is an absolute travesty as humanity musters its resources for an existential battle against climate change. "The merge" is about to flick the off-switch on an energy drain larger than the countries of Israel, Chile, Austria or Venezuela, and that's an incredible achievement – even if the network has poured hundreds of terawatt-hours down the global toilet to date.

This move does nothing, however, to address the biggest climate criminal in the crypto space. The Bitcoin network remains on the proof-of-work model, and its total energy consumption rate is estimated to have billowed out to an incredible 200-plus TWh/year through the first half of 2022. A single bitcoin transaction is estimated to produce a grotesque 776.13 kg of CO2 emissions, and uses enough electricity to power the average US home for a little over 47 days. A single transaction, with much of the power sourced in the world's cheapest markets.

And again, to what end? To power hundreds of thousands of computers in crypto-mining arrays as they perform essentially useless calculations, simply to prove the miners have spent enough money on power and GPUs to be trustworthy validators for the blockchain. Nothing is created, and there's no other economic value to this activity. It's hard to view this as anything but obscene, and the Bitcoin network has no plans to move to proof-of-stake, or any other model, at this stage.

Still, this is a critical moment for crypto, and anyone environmentally minded should hope it works out well for Ethereum. Learn more in the video below, and you can check Google to see a countdown to the moment when this historic switchover occurs.

Source: Ethereum.org