A Mercedes-Benz just sold for US$52.4 million (€51.15 million) at auction, though the real story is the relentless and somewhat foreboding rise in collectible automobile prices … and there's another auction tomorrow that might change the story again.

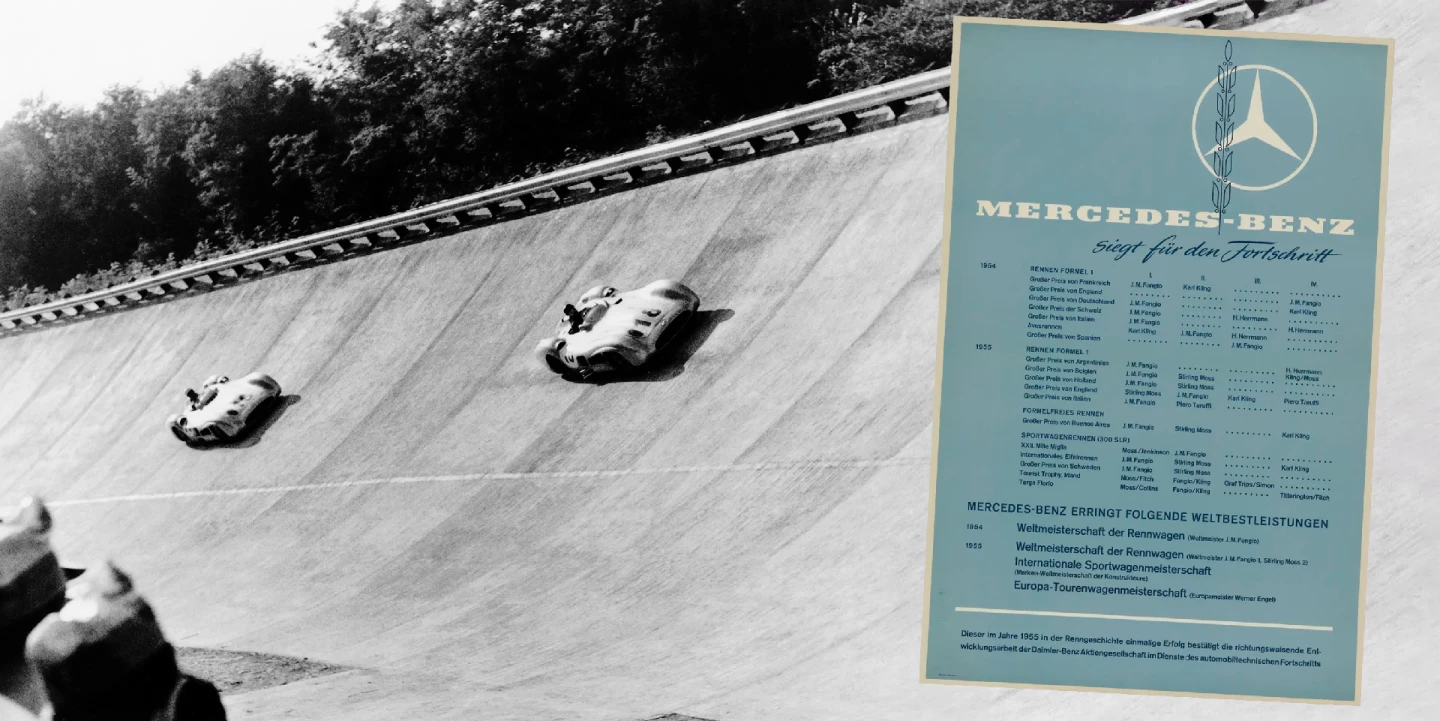

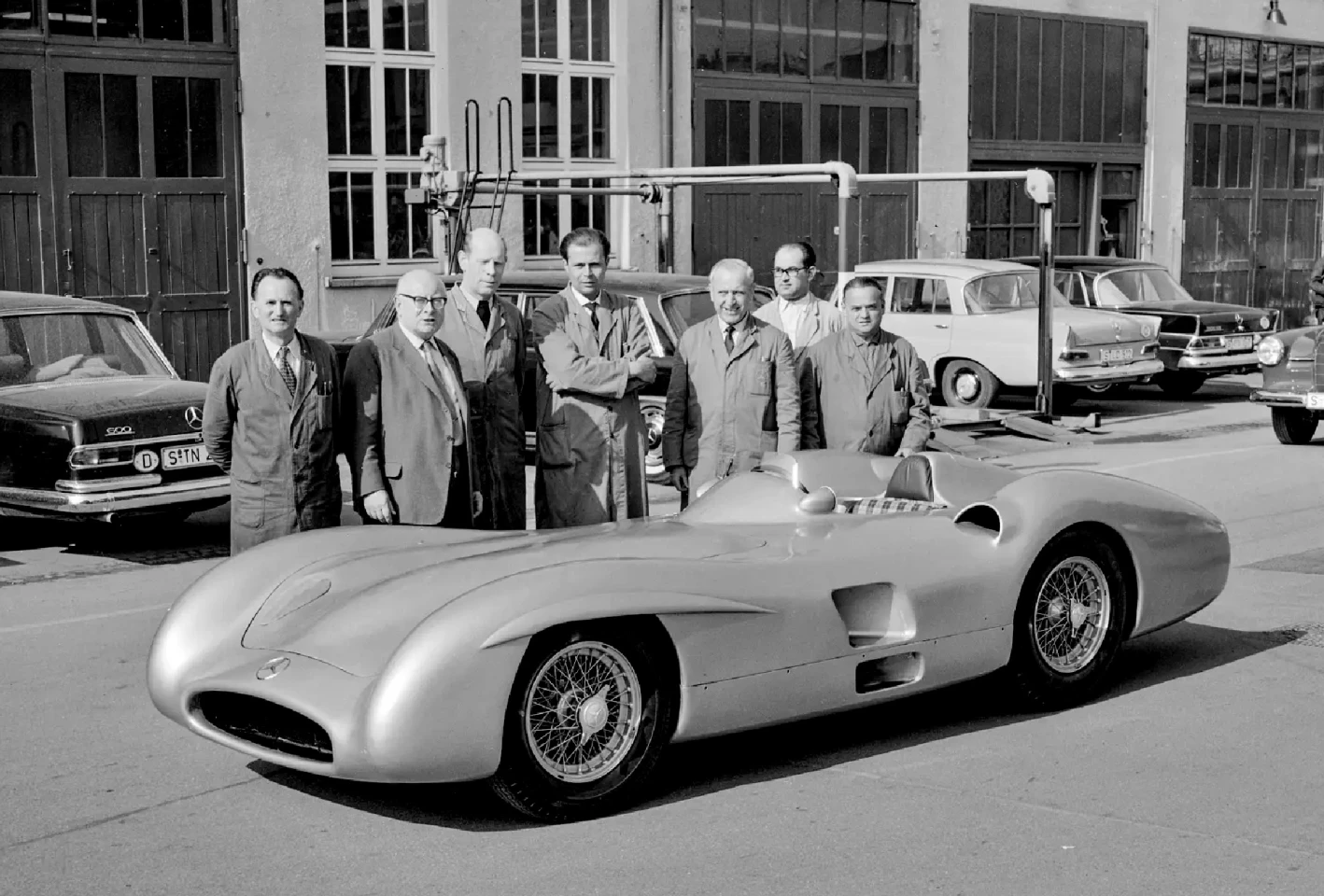

RM-Sotheby’s sold the one-of-four Fangio/Moss Silver Arrows at the Mercedes-Benz Museum in Stuttgart (the same venue as the record-holder), where it became the second-most expensive car ever to sell at auction.

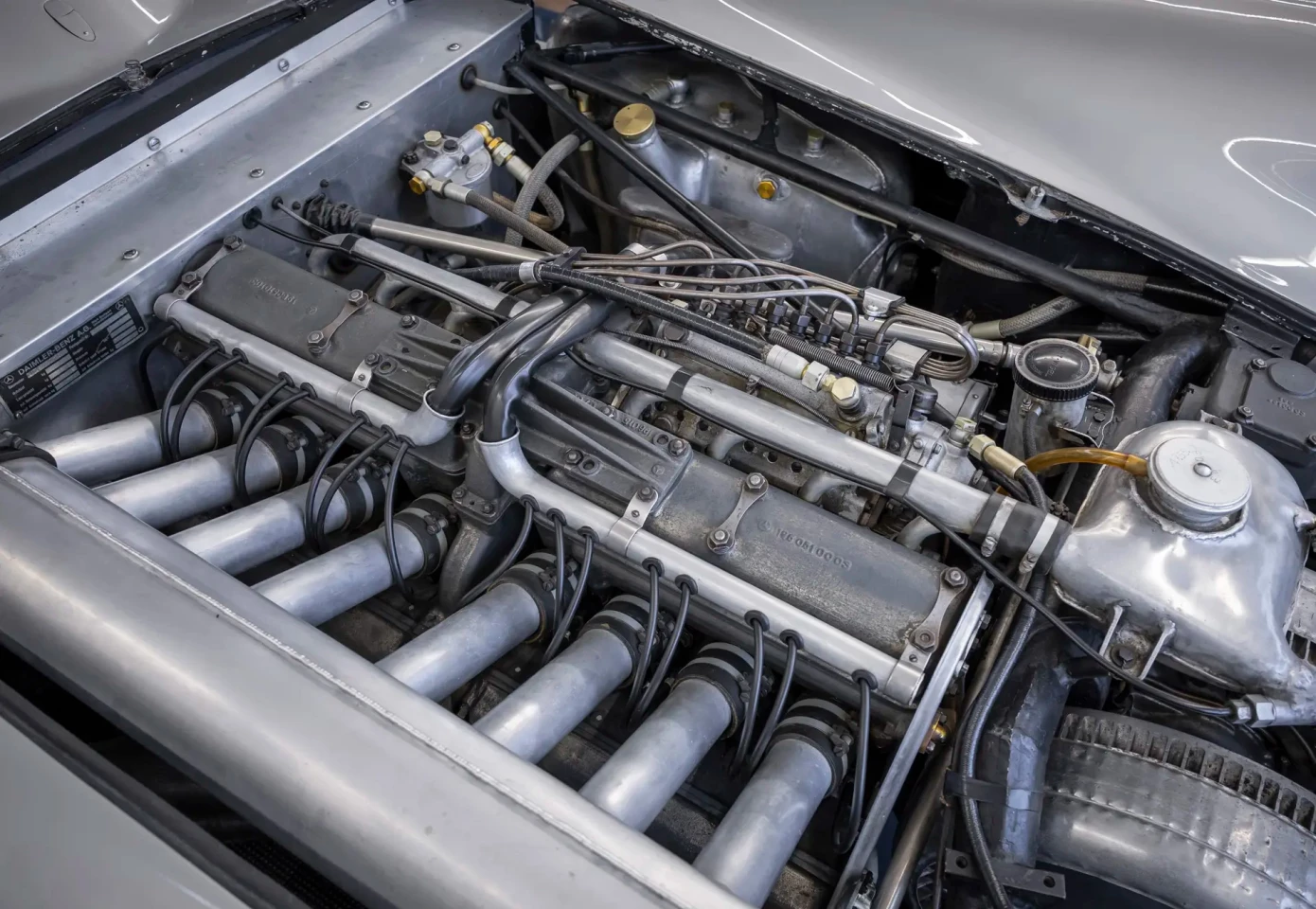

The W196 R Stromlinienwagen was sold by RM Sotheby’s at an auction held at the Mercedes Benz Museum in Stuttgart on behalf of the Indianapolis Motor Speedway (IMS), which was gifted the car by Mercedes-Benz in the 1950s.

It has been displayed at IMS for many decades, but museums need to evolve and stay relevant in order to be financially viable.

In an effort to refresh and refocus the IMS Collection, two cars are being sold to provide funding for new, more congruent acquisitions, as they are technically from different racing genres.

The other car from the Collection is going to auction tomorrow in Paris (5 February 2025) at the industry’s mecca event, Retromobile in Paris.

It’s a 1964 Ferrari 250 LM and it’s the ideal place to sell a car with an official guidance that reads “In Excess Of €25,000,000.”

Here’s the new $20-million club roll call, and you’ll note that a 1962 Ferrari 330 LM / 250 GTO sold for $51.7 million just 15 months ago, and the financial environment is such that there may be a few ships seeking safe harbor.

The 1962 Ferrari 330 LM / 250 GTO on offer has a full hand of provenance, matching everything, a filing cabinet full of documentation, parts and service invoices, and a comprehensive history report by Marcel Massini.

From the catalog report, it is “the sixth, and most important, of 32 examples built of the 250 LM."

It is the only privateer-entered Ferrari to win the 24 Hours of Le Mans (1965), competing in six 24-hour races (three times at Le Mans and three times at the 24 Hours of Daytona) and it was the Ferrari show car at the 1967 New York Automobile Show. It has spent the last 54 years of its life in a museum.

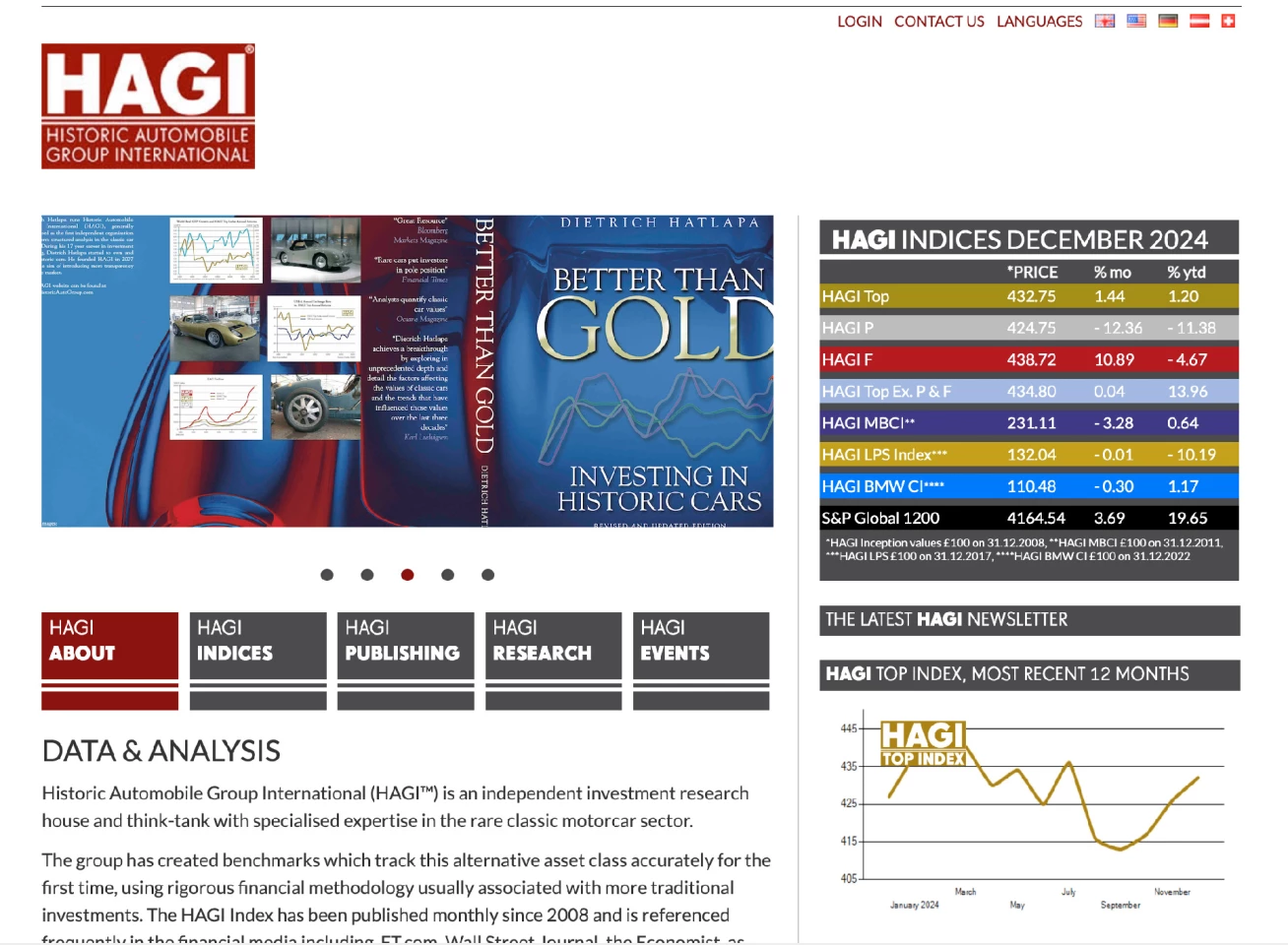

In times of great uncertainty, the world’s most astute money managers store and protect value in many ways, and rare automobiles happen to act particularly well as an economic hedge.

That’s not an unsubstantiated claim, as Historic Automobile Group International (HAGI) now tracks the entire marketplace with a number of indices on different areas of the marketplace.

Judging by the rush to buy iconic automobiles of recent times, it seems we are living in the “interesting times” promised by the ancient curse.

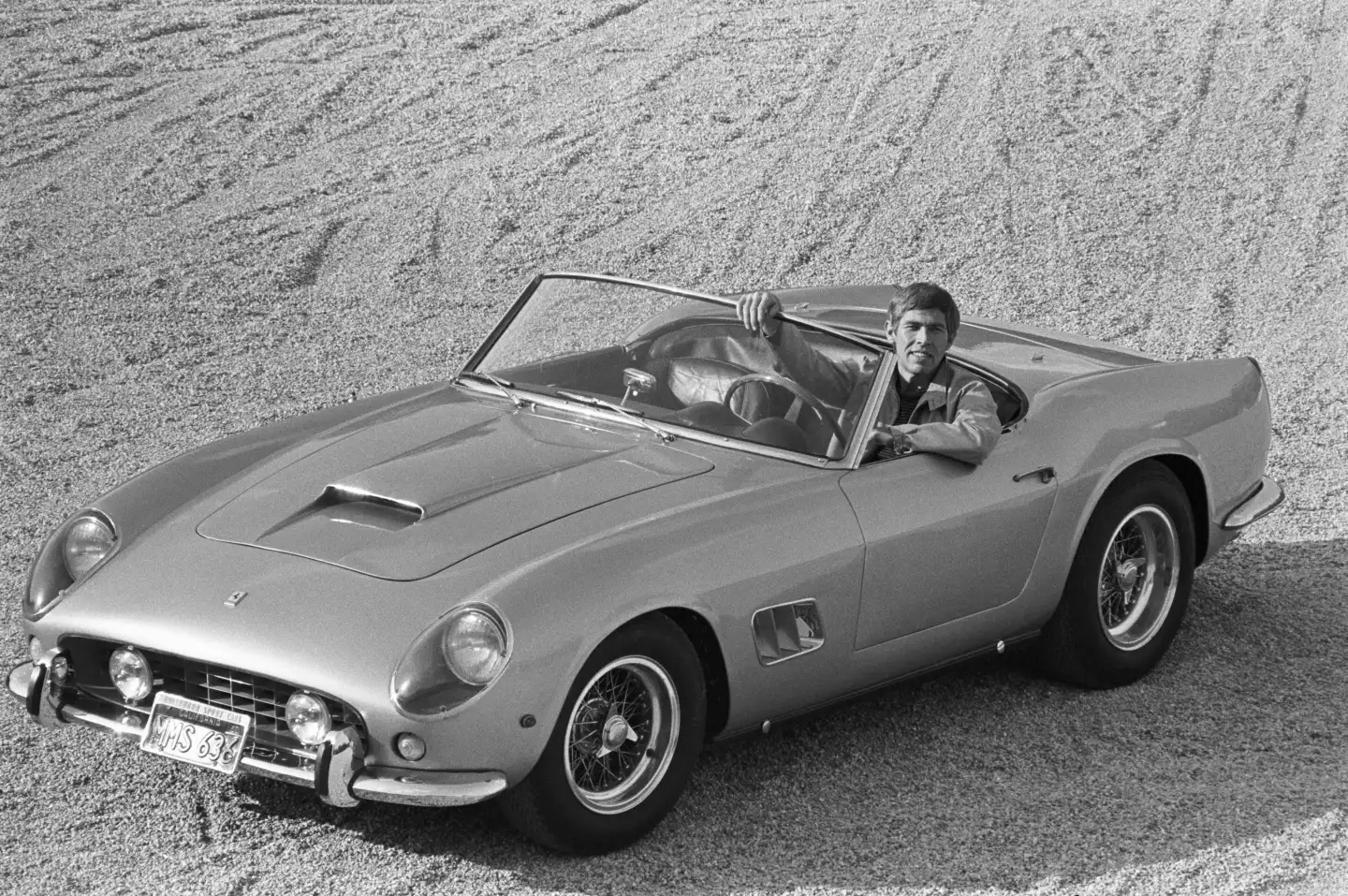

The first car to sell for more than $10 million at public auction was in 2008 – a 1961 Ferrari 250 GT SWB California Spider with movie star provenance.

I remember writing the story at the time – to almost everyone, it seemed like madness that someone should pay that much for a car. Wrong. After a lifetime of writing about auction prices, I’ve watched countless auction genres kept alive by the geeks of the world ("guilty yer honor"), grow from swap meets to gargantuan size.

Baseball cards, baseball bats, baseball shirts and baseballs that once sat on a mantlepiece as a keepsake are now worth millions and their value is more secure than most of the world’s currencies.

Auction genres have emerged from nowhere. In the first months of 2020, the world record price for a video game was $75,000. It jumped to $114,000 in July, then $156,000 in November. In 2021 we saw a new record of $660,000 in April, then $870,000 and finally $1,560,000 in July. That means the record progressed by an order of magnitude in 16 weeks, from $156,000 to $1.56 million.

Ticket stubs from important sporting games and musical concerts are now worth hundreds of thousands of dollars, and just a few years ago, there was no marketplace in which to buy and sell them. Computer relics from digital antiquity excavated from attics, ditto, and there are dozens of examples of people who paid unholy amounts for a bottle of whisky prior to 2000, only to find their justification to their wife turned out to be true, and it did appreciate in value far faster than almost anywhere else.

The forever-rising tide of collectible prices has sured up the investment portfolio of many people over the decade and a half since things really kicked off for collectible automobiles.

Those once outrageous prices turned out to be sound financial decisions when judged by the perspective of history.

The annual turnover of collectible car auctions and online marketplaces was estimated by Statista at $31.6 billion in 2022. Throw in the brokers and dealers and restorers and the service providers to those industries, the transporters, and the not insignificant global insurance bill on collectible cars, and the money figure for the entire collectible car industry is much larger.

In 2016 I covered Auto Classica in Essen Germany in great depth. Auto-Classica is Germany's answer to France's Retromobile, except it's bigger, and the article will give readers some insight into the depth and breadth of the collectible car industry.

Maybe much, much larger, because common wisdom has it that around two thirds of the global collector car market is conducted through private sales, prestige dealers and brokers, with the most visible and valuable third sold at auction.

Since that 2008 RM Sotheby’s auction in Maranello (Ferrari’s home), 76 cars have sold for more than $10 million.

The $20-million milestone was first reached by a Mercedes-Benz W196R in 2013, and counting the new Mercedes-Benz W196R sale, 19 cars have passed that marker.

The record price for an automobile now stands at $143 million. The car was built by the same Mercedes-Benz team headed by Rudolph Uhlenhaut.

It may all seem academic to us worker bees, but the moral of the story is that wealth management now fully accepts investments of passion such as jewelry, whiskey, entertainment memorabilia, sports memorabilia, baseball cards, and automobiles as legitimate alternative investment strategies.

The numerous free, detailed annual wealth management reports from PwC, Capgemini and UBS all have pages devoted to these pastimes, which were once regarded as frivolous and wasteful.

Sadly, like the whiskey we once fretted had stopped being enjoyed because it had become a notional financial construct, the corollary of these news-making high prices is that God is coming for your collectible car/motorcycle – if it’s a good'un, it might soon be too expensive to do what it was built for.

Source: RM Sotheby's