One of the most exciting companies in grid-level renewable energy storage – if you're the type to get excited about this kind of thing – is Form Energy, whose innovative iron-air technology promises to outperform lithium "big battery" projects at 10% of the cost. It's preparing to scale up with its first factory.

Form's grid-scale batteries are built around huge flat iron-air cells, about a meter (3.3 ft) square, around 50 of which are slotted into modules the size of a washing machine and bathed in a liquid electrolyte. These cells effectively work using the rust cycle; you charge them up by applying energy to iron oxide, turning it back into metallic iron, then add oxygen to initiate the rust process and release energy.

Iron is cheap and abundant, making these modules extremely affordable. They last a long time, they're safe and they're recyclable; if you tear down a battery you can take the metal out and use it elsewhere. These factors all combine to make them an exceptionally affordable form of energy storage, with a Levelized Cost of Storage (LCoS) more than 10 times lower than lithium batteries, even before you take the expected lithium resource squeeze into account.

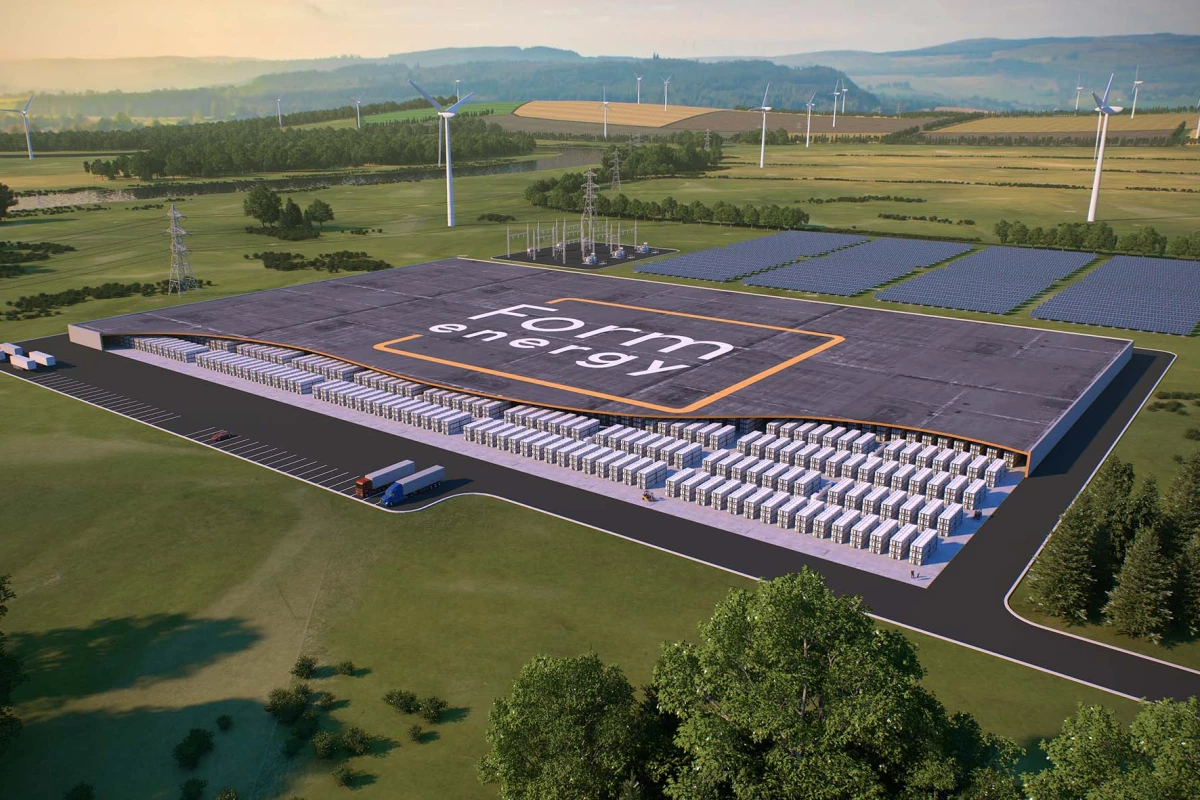

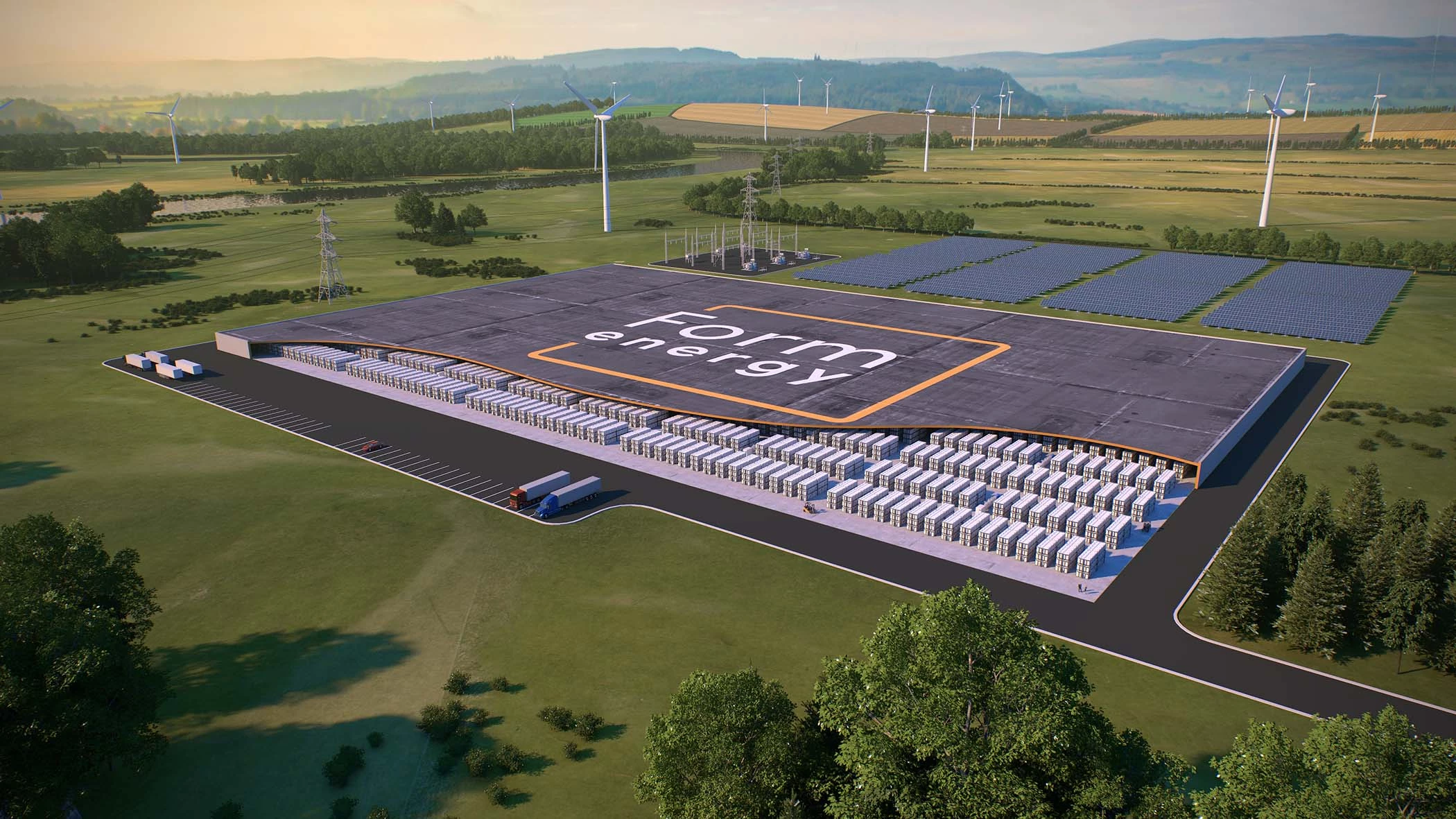

They won't charge or discharge as quickly as lithium, of course, so they'll likely work alongside lithium grid batteries in hybrid configurations, the iron-air batteries dealing with longer, slower load demands while the lithium packs handle momentary spikes. Form says that at scale, they'll deliver more than 3 MW of output capacity per acre, and they'll excel where energy needs to be stored for around 100 hours or more.

That's a key vulnerability in any renewable grid; it's the kind of storage you need when there's a terrible storm for several days that drastically cuts solar and wind production. Form's proposition has certainly made a splash with investors; Bill Gates's Breakthrough Energy Ventures has been on board for some time, along with Luxembourg steel giant ArcelorMittal and many others. A Series E investment round dragged in an impressive US$450 million, bringing the company's total funding over US$800 million.

So it's time to go commercial. Last month, the company announced it had chosen a site for its first American battery manufacturing plant: a 55-acre facility in the city of Weirton, West Virginia. The US$760 million project will employ around 750 people, with construction expected to start later this year and the first iron-air batteries to start rolling out in 2024 "for broad commercialization."

Source: Form Energy