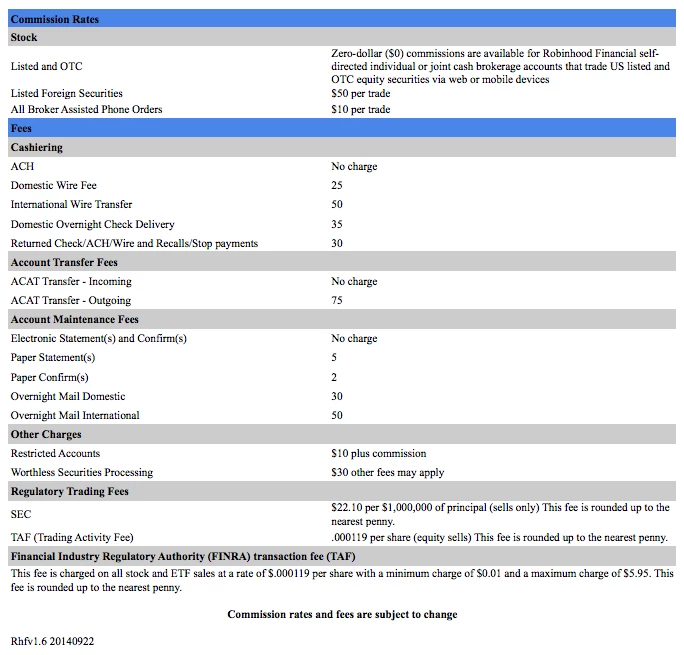

Stock trading has never looked particularly inviting to young, first time investors. Minimum balances and US$8 per trade fees make it hard to dip your toe in the water. Startup brokerage Robinhood, which has just raised some $13 million in venture capital, is aiming to change the game and invite a new generation of mobile investors onto the trading floor with a beautiful, simple trading app for iPhone, and zero-commission, zero minimum balance stock trading.

One of the many advantages large institutions hold over small, private investors is that where the individual has to fork out between $5 and $10 per trade, the institutions are getting charged fractions of a cent.

The cost of entry can also be too high for many folks to consider dipping a toe in the water with many of the cheaper per-trade options requiring you to hold a minimum balance in the thousands of dollars before they'll let you participate.

Most trading companies have no interest in attracting youngsters and first-timers into the fold. They want to deal with experienced investors with decent sized portfolios. Robinhood is the opposite, a tech-focused company that's specifically targeting young people with zero-commission trades and no minimum balance for participation.

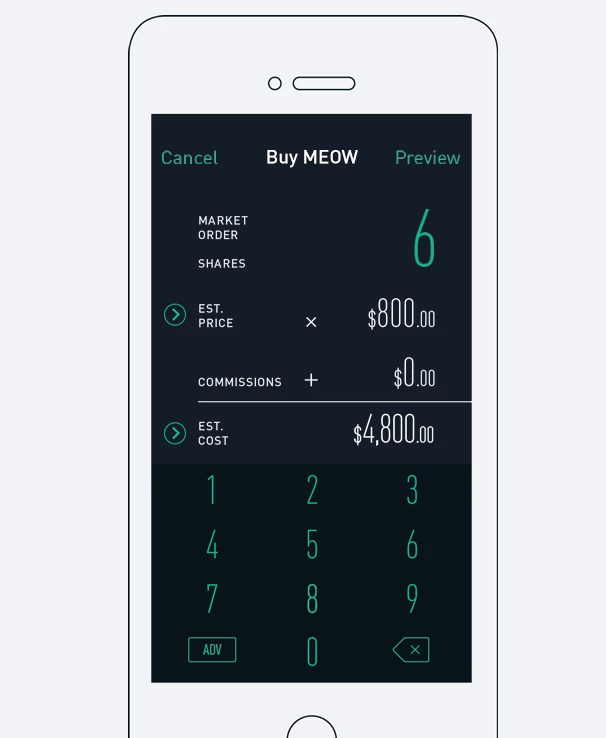

Robinhood's business, started up by a couple of Stanford grads, is centered around its mobile app. It's a pretty, user friendly iPhone app (Android app is on the cards sometime in the future) that makes trading look stylish, fun, easy and social for investors. Users can link in a bank account and trade directly using those funds.

It's certainly easy on the eye, with the app displaying in black when the markets are closed, white when they're open. Stocks pop up in red if they're losing money or green if you're winning, and trades can be executed in just a few steps. Market data is viewed in real time and the app gives users notifications on upcoming scheduled events, such as earnings, dividends and splits.

Having recently raised some $13 million in venture capital, Robinhood is currently in beta testing, with 80 percent of its user base under the age of 30. There are nearly half a million users waiting to join once security and reliability testing is completed to the company's satisfaction.

How does Robinhood make a dime without charging fees for small trades? The company plans to charge for "premium services for active investors," as well as offering API access to its platform to other companies. It will also "receive remuneration for providing trade volume in certain markets."

Zero-commission trading with no bricks-and-mortar storefront or Wall Street presence, targeted at young investors and providing a clean, simple and fun mobile experience – this could be a very disruptive technology in the finance world, and could encourage a lot more people to get into the stock market.

It will be interesting to see how companies like E*Trade, Schwab and Scottrade respond to the Robinhood value proposition with this kind of competition having the potential to make the lower echelons of the investing world a lot more democratic.

Source: Robinhood