As the EV revolution speeds up, and big battery projects ramp up to stabilize power grids running on intermittent renewables, global demand for lithium batteries will rise sixfold in the next 10 years. But can the world actually supply the materials?

There are many potential emerging alternatives to lithium batteries, but for the time being, lithium remains the best commercially available option for a wide range of use cases, and it's unclear what will rise to replace it, or when. We're already getting a small taste of a lithium squeeze, thanks to a freak heat wave that disrupted supply in China's Sichuan province last month.

A new report from EV supply chain market intelligence publisher Benchmark gives us a sense of what rising battery adoption means at the resources level. Even assuming the recycling of raw materials, the report suggests we'll need about 336 new average-sized mines by 2035.

That breaks down into around 59 new lithium mines producing an average of 45,000 tonnes, 38 new cobalt mines producing 5,000 tonnes, 72 new nickel mines producing around 42,500 tonnes, 97 new natural flake graphite mines producing around 56,000 tonnes a year, and 54 new synthetic graphite plants producing an average of 57,000 tonnes each per year.

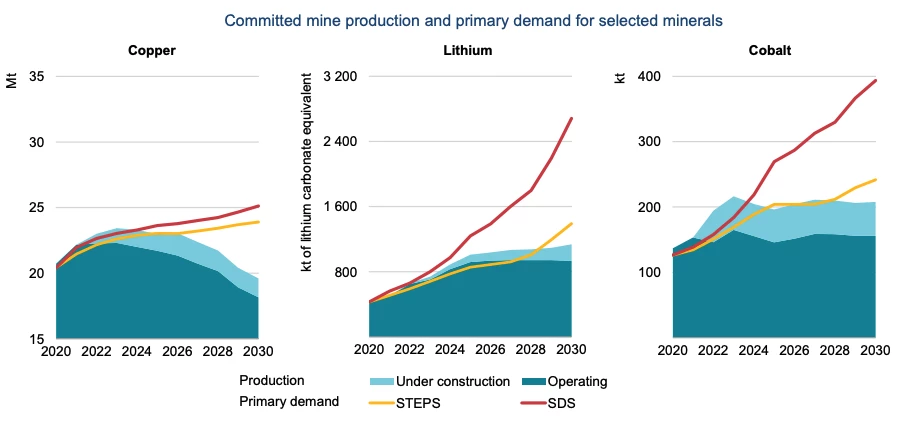

Looking at lithium specifically, this soft, silvery-white metal is projected to be in surplus in the short term, according to the International Energy Agency, but by 2030, existing mines and projects under construction will only be able to produce about half of what's needed to satisfy demand. What's more, the same report found that lithium mines that started operations between 2010-2019 took an average of 16.5 years to develop.

Add to that the fact that these mines will need to be up and running by 2033 in order to feed the supply chain for 2035, and it starts to become clear that a number of new operations will need to ramp up at unprecedented speed to avoid a crushing lithium squeeze.

The demand won't stop rising there, either. The World Economic Forum estimates that around two billion electric vehicles will be needed by 2050 for a global net zero carbon push – up from around 16.5 million on the world's roads today. Large jurisdictions like the European Union, China, Japan and a number of US states are bringing in legislation to speed up the transition, putting end dates on the sale of fossil-fueled cars. Are they planning to walk these dates back if there simply aren't enough batteries to make EVs?

The supply picture looks worse still if solid-state lithium batteries take off quicker than expected; their pure lithium anodes could push demand higher by up to 22% over current projections. And huge grid battery projects will rise in proportion to the share of renewables in each country's energy mix – although since physical size and weight are less important, other technologies like flow batteries could step into this space.

Another issue is water. Conventional lithium extraction requires huge quantities of water, and most of the world's biggest reserves are found in areas where water scarcity and drought is already an issue, like Australia, Chile, Argentina and Bolivia. And some operations potentially contaminate local groundwater with metals such as antimony and arsenic, making them very unpopular with farmers and residents.

There are some promising-looking extraction alternatives, like this Saudi research into cheap lithium production from seawater – which desalinates the seawater in the process, and also generates hydrogen and chlorine gases as additional revenue streams. This is a lab prototype, not a large-scale commercial operation, and while there's plenty of lithium in the sea, there's certainly no guarantee that this nascent process, or other similar ones, will prove scalable enough to fill the coming hole in supply.

The lithium battery has been one of the key foundational pillars underpinning the world's technological progress in the last couple of decades. Without them, the cell phone couldn't have become the smartphone. Absent the groundbreaking power and energy density of lithium, drones and eVTOLs make no sense, many portable and mobile devices would never have made it to market, and electric vehicles would be hamstrung by crippling range figures, so hydrogen-based powertrains might be the only practical path toward decarbonization.

But it seems very likely that an extended lithium squeeze will hit within the next few years, pushing up battery prices and putting some harsh brakes on global decarbonization trajectories in the coming decades. So the development and commercial rollout of alternative battery and clean fuel technologies is of critical importance.

Sources: World Economic Forum, IEA, Benchmark Minerals