As the world rushes toward "the greatest disconnect between supply and demand in the history of commodities," Snow Lake Lithium CEO Philip Gross talks us through his company's plans to open the world's first all-electric lithium mine in Canada.

Now that we're starting to see the chaotic and destructive early effects of climate change begin to wreak havoc the world over, the world seems to have finally reached a consensus that we need to decarbonize as rapidly as possible. Which is great – better late than never. But a huge percentage of the push toward net zero carbon by 2050 is going to rely on batteries, and the simple fact is this: there's not going to be enough lithium.

There's plenty in the ground, but as we wrote a couple of months ago, there's nowhere near enough coming out of it, and while everyone seems to be expecting electric vehicles to continue taking over the auto market, the numbers look dire. By 2030, if all existing mines keep producing and everything that's under construction comes to fruition, there'll still be barely enough metal to satisfy half of demand. This will be a lithium resource squeeze of epic proportions.

"Anyone who doesn't see this coming is putting their head in the sand," says Gross, clearly exasperated. "And it's not just top down, governments pushing this on consumers. The consumer demand for EVs is already insane. We have a new generation who are finally conscious about these issues, and they want to do something about it. These people are already putting their names on two-year waiting lists for electric cars, they're putting the payment down and waiting literally years for their cars. It's wild. And it's the tip of the iceberg, because all the electric cars you're seeing now are high end – US$50-60-grand cars minimum. We're gonna get down to the US$30-grand car soon."

"The consumers are overwhelming the manufacturers," he says, "so the manufacturers are pushing down on their battery guys. And the battery guys are saying OK, we'll build another factory for you. They're building 13 or 14 gigafactories now, just in North America. And there's no raw material to meet that. This is a massive, organic growth in demand that didn't exist three, five years ago. It's a monumental disconnect between supply and demand, and there's no way to fix it now, other than going on your hands and knees to China. China has no interest in supplying you with lithium or batteries. Their end goal is to dominate the automobile industry."

While the bulk of the world's known lithium resources are located in Australia and South America, Chinese businesses own large stakes in most of the mining operations. More than two-thirds of global lithium processing is done in China, and China makes somewhere around 80% of the world's batteries. Lithium mines take at least a decade to get up and running; there's scant chance of the Western world catching up.

The Chinese government got an advance look at the effects of heavy urban pollution back around 2010, and had the foresight to make big decisions, invest heavily in electrification and lock up the supply chain for lithium, cobalt, neodymium and other critical metals. Now it's becoming apparent: this is a legitimate national-security-level resource threat for countries like the United States.

"Nobody was interested in lithium for decades," says Gross. "People used it in ceramics, and some pharmaceuticals, and that was the entire market. Snow Lake's lithium resource was found back in the 1930s, and it was a huge disappointment. They kept drilling, desperately hoping for gold. Nobody in the history of the world ever bothered looking for lithium. No money was spent on it, and no money was spent on ecosystems. If you bring lithium out of the ground in North America, you can't do anything with it unless you send it to China."

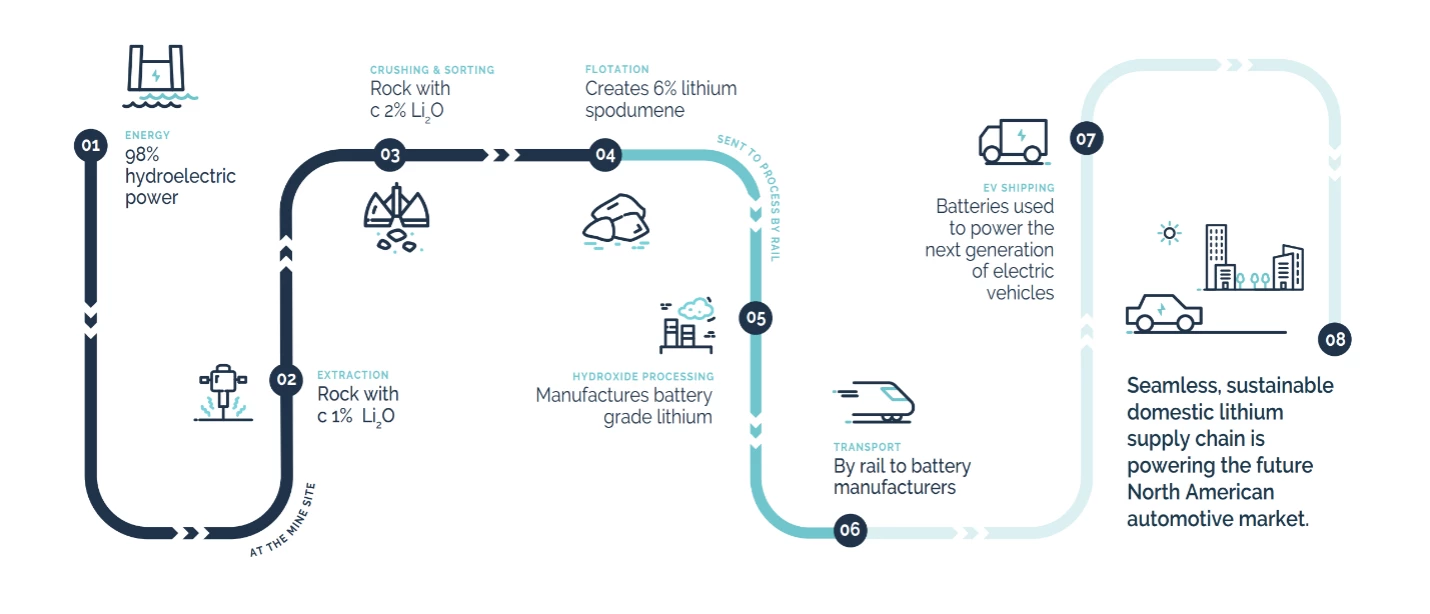

Thus, as Snow Lake Lithium races to create the world's first fully-electric lithium mine to pull that metal out of the ground and process it into 6% spodumene, it's signed a MoU with Korean battery giant LG, which is planning a hydroxide processing plant nearby, capable of taking that spodumene and turning it into battery-grade lithium ready for the gigafactories. And so begins a fledgeling North American lithium battery supply chain.

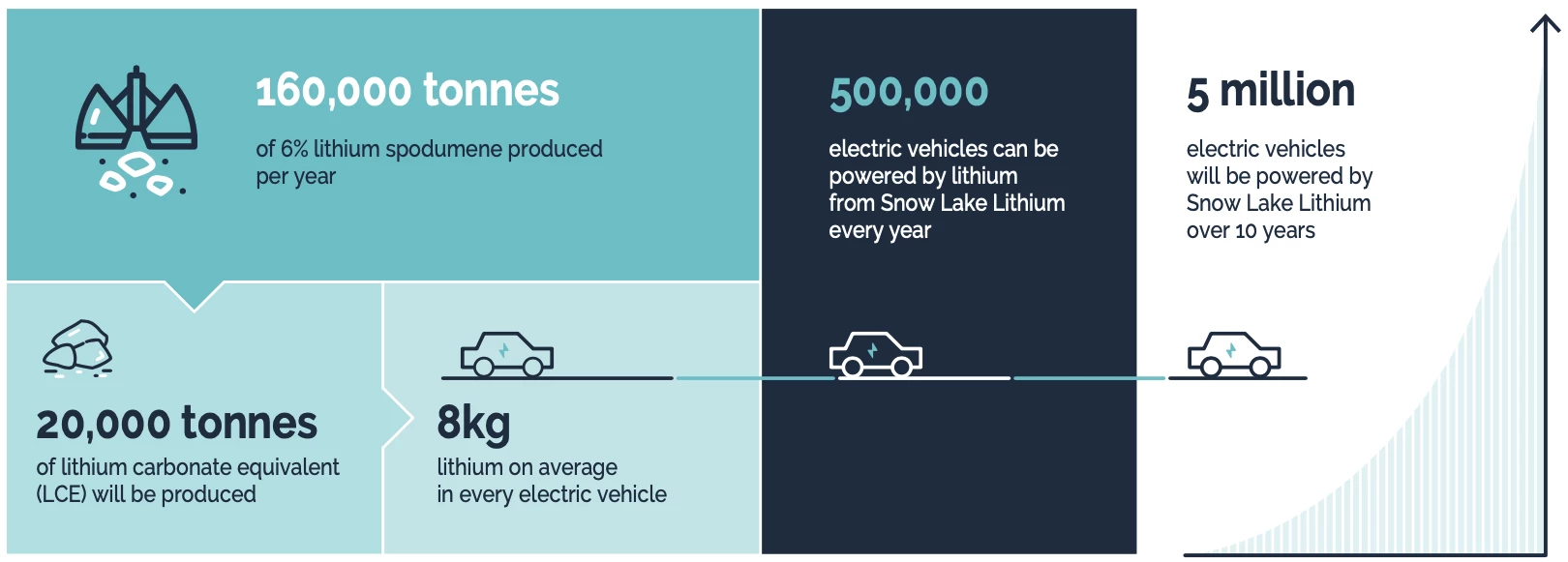

Snow Lake's 55,000-acre site is located some 400 miles north of Winnipeg, and the LG plant will be close by, perfectly positioned to move bulk product down into the centre of the USA and out to every major manufacturing center via rail. With just 1% of its property explored, Gross says the company expects to supply around 160,000 tonnes of 6% spodumene a year, opening in 2025 or 26.

It'll be a super-clean operation; this is not a brine-based lithium extraction operation capable of contaminating groundwater and drinking water supplies.

"We're doing hard rock," says Gross."You take the rock out of the ground, you smash it, and you take out the critical element you're hoping to obtain. We've been doing this for thousands of years, for better or worse. We know it, and we can mitigate the impact of that.

"We're very fortunate with our location," he continues, "not just because this is a well-established mining area with a built-in workforce and a government that understands resources, but also because Manitoba is a 99% renewable energy area. There's some criticism out there – totally misplaced and completely fallacious, in my view – that if you drive an EV, you're somehow doing something worse for the climate than a gasoline car. You're not; if you burn a gallon of fuel, it's gone. Almost all the components of a battery can be repurposed and rejuvenated and recycled. And it's possible to do mining in a way that's carbon neutral, responsible and sustainable. We'll have to be responsible to our customers. I think in the not-too-distant future everything you buy is going to have a carbon impact number on it, like calories on a chocolate bar. So we can't compromise on environmental impact, that's our responsibility."

Snow Lake is working with Swedish company Epiroc, which will be supplying the all-electric mining equipment for the site.

"If we were going into production today," says Gross, "some of that equipment doesn't exist yet. They're working on it now. We're fairly confident it'll be available on schedule. But there's plenty of challenges ahead, nothing is straightforward. Canada in the winter, it gets to -35, -40. Special conditions, a lot of testing needs to be done to make sure the batteries operate optimally, all that sore of thing. But that's the challenge we've taken upon ourselves."

If everything goes to plan, Snow Lake will supply enough lithium into North America to make batteries for around 500,000 electric cars a year. That's a drop in the bucket compared to the 17-million-odd vehicles sold annually before the pandemic hit. Consumer demand is already shifting hard toward electric vehicles, and this trend is expected to accelerate sharply.

"The real insanity in the lithium market," says Gross, "doesn't hit until 2025, 26. Look at electric cars alone; in 2021, there were six and a half million electric cars sold globally, that's double the previous year. Let's say this year it's 10 million. It's not a lot of cars yet, but we're at the point where you see it doubling year on year. There's a cascade that unfolds from around 2025, where legislation starts kicking in, corporate fleets start electrifying, manufacturers will start rolling out new and more affordable product lines, the infrastructure will develop to support more widespread EV uptake ... That's when it's going to get really crazy."

North America's late arrival to the EV party could end up being an existential threat to its auto industry, if it can't get its hands on enough raw materials to compete with a flood of cheap, high-quality Chinese imports. We are certainly headed for interesting times.

Source: Snow Lake Lithium