It's going to take decades to get aviation, shipping and long-haul transport down to zero emissions. The technology is embryonic right now, and some of these big vehicles are still in service 30 years after they're first delivered, so even once the tech is ready, the transition is going to be painfully slow.

But there's an interim solution, set to hit the market soon, that will allow these big polluters, as well as fleets of smaller vehicles, to totally decarbonize their transport operations – instantly, without so much as laying a spanner on their existing engines.

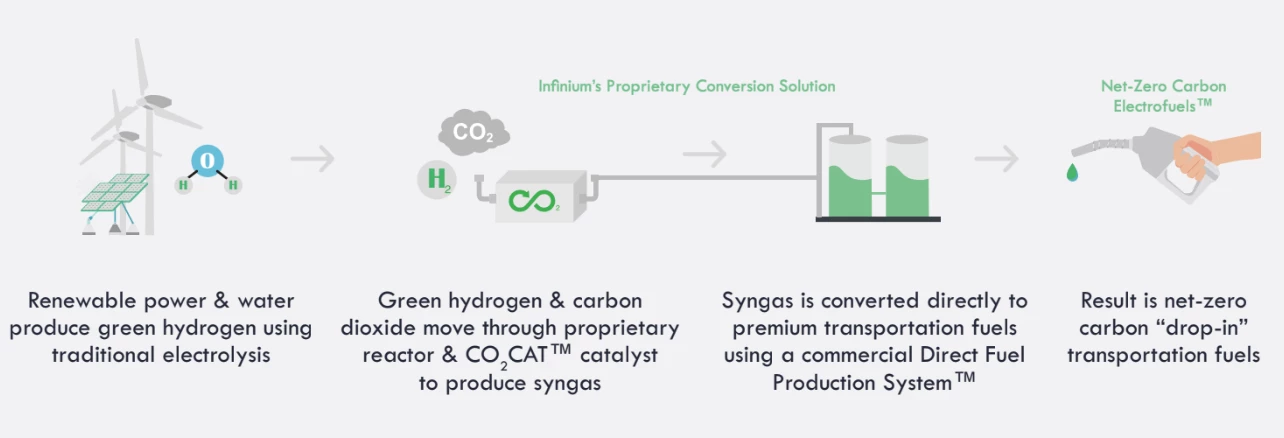

It works like this: you find an industrial operation that can't avoid releasing a heap of carbon dioxide into the atmosphere. You capture that carbon, and combine it with hydrogen generated from clean, renewable energy sources to create a synthetic hydrocarbon diesel or jet fuel.

You run that otherwise perfectly normal fuel through your airplane engines. And yes, they belch CO2 into the atmosphere as a result – but to extend on a thoroughly unnecessary metaphor, you get one belch for two meals. When you create your fuel from captured CO2, you're adding zero net carbon to the atmosphere.

Sacramento company Infinium calls these liquids electrofuels, and it's gearing up to get them onto the market at scale, and at a price point that could be competitive from the get-go in certain subsidized markets.

It's not a perfect solution, but it'll be an important interim step for industries that are still waiting for viable alternatives. It's also a much handier way to store renewable energy than hydrogen itself, which is a pain to store and transport – and the same technology can also be used to create carbon-negative plastics, and other chemicals that you'd otherwise need to use petroleum for.

We caught up with Infinium CEO Robert Schuetzle for a chat about how electrofuels are made, who's going to be using them, what they'll cost, and how this space will develop over the coming years. What follows is an edited transcript.

Loz: OK, so what exactly do you guys do?

Robert Schuetzle: Infinium focuses on the production of what we call electrofuels – producing liquid fuels that are drop-in or direct replacements for today's fuels. Like diesel fuel for long-haul transport, diesel fuel for marine, and jet fuel for aviation, but instead of using petroleum or oil, we use renewable power and CO2 that would otherwise be emitted to the atmosphere.

The renewable power is used with traditional electrolysis to generate green hydrogen, and then our technology takes the low-carbon hydrogen stream, and the CO2 stream and produces what we call electrofuels from those feedstocks.

Even though Infinium is a new company, it's based on 10 years of work under our predecessor Greyrock Energy. Last year we raised a funding round with Amazon, Mitsubishi Heavy, AP Ventures out of London, a German industrial conglomerate called Neuman-Esser and the Grantham Foundation Neglected Climate Opportunities Fund, and kicked off Infinium on its own trajectory. We felt it was the right time to start getting commercial electrofuel volumes into the market.

Where do you get those captured CO2 emissions from?

We can use any CO2 source, based on the economics and availability. Right now most of our projects are dealing with relatively pure CO2 sources from industrial plants: ethanol facilities, ammonia facilities, natural gas processing chemical facilities, operations that are currently emitting CO2 into the atmosphere. That becomes a feedstock for us.

As we advance, we're working on a few projects that do post-combustion capture from power plants or refineries. And then our third horizon that we're very excited about is direct air capture: capturing CO2 from the atmosphere. We're tracking that space carefully. We don't have technology in that space, but we'll be a buyer of direct air capture systems to feed our plants when they're commercially and economically viable. So today, highly concentrated sources, there's plenty of that. But eventually, broader CO2 as the cost curves come down.

I guess the long term goal is to get to zero emissions with the vehicles themselves, but this kind of thing is a valuable, immediate, interim step. It's still putting those emissions back into the atmosphere, effectively, but it's zero net emissions because the fuel's made from CO2 that would otherwise have been emitted somewhere else.

Yeah, that's exactly right. We're capturing that CO2, but yes it's emitted on the other end. It's a net zero carbon cycle. So Amazon as a customer can help to achieve their net zero carbon goals, especially with aviation and long haul transport – things that are hard to electrify or change over – immediately, by using these electrofuels versus having to change over vehicle fleets that could take years or decades.

OK. So with any measure like this, the key factor is cost; how much of a green premium do users pay?

Correct. So these fuels are more expensive to produce. Today, a lot of that is because electrolyzers are pretty expensive. Renewable power costs have come down considerably in the last five to 10 years – that's a big reason we spun out Infinium last year – but electrolysis is still expensive.

So our fuels today do require subsidies in markets that support a premium, like California's low carbon fuel standards – that's a US$4 billion credit program, and we achieve a close to zero carbon intensity. So we garner a significant premium here in California. State of Oregon has a program, Washington is almost done with theirs, BC has a very attractive program. The UK's program is just gearing up. Scandinavia has significant requirements coming, as well as the broader EU.

We do require those subsidies for these plants to be economical so we look at targeting our fuels for subsidized marketplaces, even if they're not necessarily produced there.

Gotcha. So, pre-subsidy, what kind of cost increase are we looking at? Because obviously it's a lot more complicated than just pulling dinosaur bones out of the ground and burning 'em dirty?

Absolutely. It depends on the market and the project – a lot of variables, but these are about twice as expensive as traditional fuels today. So we've got a way to go, to get to parity. But over the next decade, all the trends point in the right direction for us. Electrolysis prices will fall – that's a huge part of our economics. Efficiencies will come up, and renewable energy costs will continue to come down. We feel really good about being at or below parity with oil-derived fuels sometime in the next 5 to 10 years.

OK so the hydrogen itself is the bulk of your cost – what about the carbon, do you get that for free?

We try! We always come in and say look, we'll take care of your emission source. Frankly, most of the conversations end up where we end up paying a little bit of money for it, you know, $10 to $25 a ton. You would think if they've been emitting it for 15 years, they'd be happy to have Infinium come along and take care of that, but it's kind of human nature: when somebody wants your product, even if it's a waste stream, they derive value there.

But, you know, we're happy to pay a little bit for it to get us a long term, committed offtake contract for the CO2 and turn that into a product for these companies, because it's a very minor part of our cost.

So what are you guys paying for green hydrogen at the moment, roughly?

On most of our projects, we do the electrolysis – so you're really paying for the power that goes into that. So wherever we go on the planet, we're looking for that nexus of low-cost renewable power – wind and solar primarily – and then a CO2 emission source that we can contract for.

Power prices, we want to be in the $20 to $40 per megawatt hour range to make it economical. That's pretty low in some places, but we're finding a number of areas with high renewable power potential that can do much better than that, because they're isolated, and they can't get their power to market because of massive transmission costs to get their energy into a population center.

What's the process you guys use to combine the hydrogen and the carbon?

We take a two step process – this is all Infinium proprietary technology, based on the gas-to-liquid work we've been doing at Greyrock for the last 10 years. The first step is the CO2 and the hydrogen get converted into syngas. Syngas is hydrogen and carbon monoxide, and it's a common intermediary for methanol production and other chemicals, it's been used for decades. Once we get to syngas, we then use our GreyCat catalysts to directly produce liquid fuels from the syngas. That's how we get to the liquids.

We've commercialized Greyrock's Gas to Liquids platform over this 10-year period, we have operating facilities at large commercial scale, and we're leveraging that for the second stage; that's one of the unique elements of this project.

Is this an energy-intensive process? I don't know much about syngas, but I seem to recall it requires a fair bit of heat.

That first stage does require an energy input, so we use a little bit of renewable power to electrically heat that stage. The second stage is exothermic, it creates heat, so we have waste steam coming off of that. But when you look at the power requirements for this whole plant, about 85 to 90 percent is the electrolyzer, 10 to 15 percent is at our pumps, motors and heaters. So the electrolyzer far outweighs the power requirements for the rest of the facility.

OK. What's the well-to-wheels efficiency of this electrofuel like? I mean, if you plonk your renewable energy into a battery, you'll get almost all of it back out. If you electrolyze it into hydrogen and then get it back out again in a fuel cell, you might get 35 percent of it to the wheels of your car. I recognize this is a bit of an unfair comparison, because you're using this as a zero-emissions solution in places where there's currently no green alternative, but how much of your input energy makes it to the wheels in an electrofuel?

Look, it's project specific, depending on how much heat recovery you do, and bells and whistles, and CAPEX/OPEX trade-offs... But you're about in the 50 percent range. About 50 percent of the power that goes into that plant is stored in the liquid fuel end product.

OK, so then you run it through a diesel truck engine at, say, 45 percent efficiency, so well-to-wheels you're looking at somewhere in the 25 percent area.

That efficiency will improve over time as electrolyzers become more efficient. That's a large part of our overall efficiency calculations.

OK, cool. So which industries are taking this fuel and running with it at the moment?

Our fund-raise was focused on getting a number of our first projects to a point where we start construction, so nobody's deployed electrofuels yet today. We're running hard to be the first to market in electrofuels. The customers we're working with are the industrial and commercial users you'd expect in hard-to-decarbonize areas: long-haul transport, marine transport and aviation.

Amazon's one of them; they're very keen on doing an all-of-the-above strategy. Of course, they're doing a lot of electrification with the Rivian deal, they're they're doing a lot of neat stuff in hydrogen ... But they recognize they're going to need liquid fuels for a long time. To achieve their net-zero carbon goal by 2040, they need a lot of fuels for ground, marine, and air travel.

We're also working with a number of airlines, as well as other logistics providers. Amazon's our flagship, we have a huge hill to climb to start chipping away at their net-zero carbon goals and we're really pushing this platform to get to scale, so we can help them meet that objective by 2040.

I guess it all comes down to economics, particularly at a large scale. So if you're a long-haul trucking company, your decarbonization options are: implement hydrogen-fuel-cell power trains directly, get yourself some battery trucks, or switch to electrofuels once they are available. Do you have a sense for what the advantages and disadvantages of those approaches would be for a big logistics company?

Sure, I mean everything's case-specific, but in our opinion, going to electrofuels is the low hanging fruit. You can get your net-zero carbon using your existing vehicles. Hydrogen retrofits are fairly expensive, but maybe more importantly, the hydrogen delivery systems don't exist globally. So if I was going to run a truck from, you know, East Coast US to West Coast US, or Sydney to Melbourne, there's no fueling stations along the way for hydrogen.

And delivering hydrogen from the places where it's cheap to produce to those transportation corridors is extremely expensive. You either have to put a liquefaction plant in, and then haul it around in bespoke cryo vehicles. Or you compress it and you're running hundreds if not thousands of trucks a day. So hydrogen transport is really the Achilles heel of that whole market in my opinion.

Yeah, right. So I guess some of the initiatives around putting it through the natural gas pipelines and stuff like that may end up helping in those regards. But this is all a little way off, and at the end of the day if you can stick a plant right next door, with a solid source of carbon close by, then you can just make electrofuels and ship the fuel around in regular petrol tankers.

Absolutely.

And trucking is one case, but something like aviation is another. There are no real decarbonization options an airline company can flick the switch on today. I realize it's hard to pull figures out of the air, but do you have a sense for how much extra it would cost a passenger to fly emissions-free like this?

Right. Well, the subsidies are very dynamic right now as low carbon programs come in internationally. I mean, for example, in the UK we talked to an offtake partner recently. We understand if we were producing fuels today, you know, we'd be somewhere in the range of a $7 per gallon subsidy, which would fully subsidize the production of these fuels and then some.

Now, the subsidy markets will have supply and demand and they'll normalize, so it's hard to say where they'll fall out. But with the EU, Scandinavia, the UK all making massive requirements around decarbonizing the fuel pool, we're seeing some good subsidy increases. California's program, which is about eight years old, has been the most mature globally. It's a $4 billion credit facility today, and there's a lot of folks selling into it, and attractive subsidies there as well.

So in some markets, you can fully subsidize these fuels. In others, the buyer's going to have to pay a premium. But again over the next five to 10 years, we do hope to get down to parity, so that we don't have to rely on those subsidies. It's not good business to be reliant on subsidies for the long term.

Roger that. So you've got a solid option here for the short and medium term, but what happens to your company when the rosiest projections come true and we find true zero-emission options for everything? Where does your business evolve to if we're running clean in 2050?

Yeah, absolutely. So if we woke up tomorrow, and there was no diesel or jet fuel demand, because everything had been switched, well, all of our products have opportunities in premium chemical markets as well, that are currently almost 100 percent derived from petroleum. Normal paraffins, solvents, other things that are very hard to replace from the chemicals market.

So even with these early projects, we're working with chemical companies that are very interested. One of our applications in Europe is using our products as intermediaries for plastics, so the plastic would permanently sequester the CO2. So at that point, you're going carbon-negative.

So we're starting to cultivate that for every slice of our product, beyond fuels. We don't know when things will turn over, but if we woke up in two days, and all of aviation, marine and long-haul was completely displaced, we have great markets in the chemical industry, and that goes into a negative-carbon situation instead of net zero.

That's very cool, I'm glad I asked you about that. It's easy to forget that there are other things that rely on hydrocarbons, other than just fuels. All right, so you've got the investments in, what stage are you at, what's next and how long before we see these things hitting the ground?

We're a few years out from having our first large projects deployed, but we're commercially ready with the technology. We're finalizing details on our first wave of projects, which will include North America and the EU. The EU has been very keen on electrofuels, there's a lot of incentives there and a lot of support, so we'll have some announcements coming out in coming months.

These will be large-scale facilities, significant investments and some large players involved, in addition to our existing cap table, so we're super excited about getting first volumes into the market and starting to help customers decarbonize their transportation.

You know, we believe that electrofuels, or converting power to products, whatever the product, is going to be a really big trend over the next five years – just because of how stranded some of this renewable power is. If you're doing green hydrogen at some remote location, there's really not a lot of great options for delivering it without converting it to a product. I've seen a huge growth in awareness around this in the last 12 months, I think you'll start to see more about it in coming months and years.

Sure. So another unfair question – who else is operating in this space, who else is getting into electrofuels?

We believe we're leading this space because of our 10 years of development work and commercial-ready technology platform. But in the last six months, we've seen some R&D announcements, some pilot programs announced from some very large players. Significant budgets going into six barrels a day, 10 barrels a day facilities.

So we think there'll be multiple solutions here, and we've been approached to be the technology platform on a few of those, but our response has been: look, we're not going to do a pilot right now – something small-scale that's not commercially viable – just to show it. We're focusing our time on large-scale facilities. We've also seen an increase in announcements about converting power into other things other than liquid fuels. Power into ammonia, power into natural gas for the gas grid, that kind of thing, so it kind of goes into that broader category of "power to x." I think you'll see more of that to come.

But hey, everybody into the pool! We need all the solutions we can get, and there's almost infinite demand for offtake on all this stuff.

We thank Robert Schuetzle for his time.

Source: Infinium