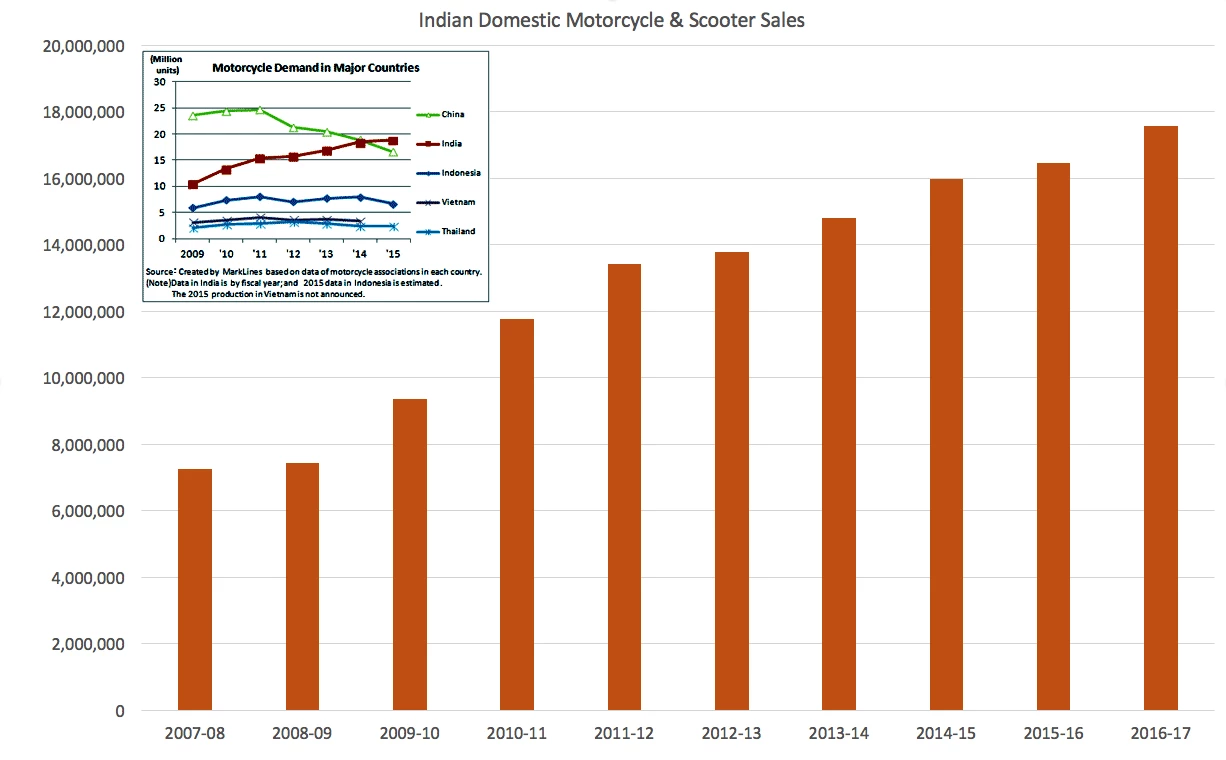

Earlier this year, India dethroned China from a long reign as the world's largest motorcycle manufacturer, having already overtaken China to become the largest domestic motorcycle market three years ago.

China's domestic motorcycle market has been in decline for five years as government policy has incentivized electric bicycle sales and denied motorcycles access to city centers across China. Conversely, the relentless growth of motorcycle sales in India has now created such momentum that it is beginning to reshape the global marketplace.

Indian sales are still expanding (6.9 percent in the last year) and are expected to do so for the forseeable future, thanks to a fast-growing 1.32 billion domestic population that is quickly urbanising and emerging from poverty – India has the fastest GDP growth of any major country. A massive India-wide road construction program is also fuelling car and bike sales, just as it did in America a century ago, introducing a time-honoured formula for invigorating an economy.

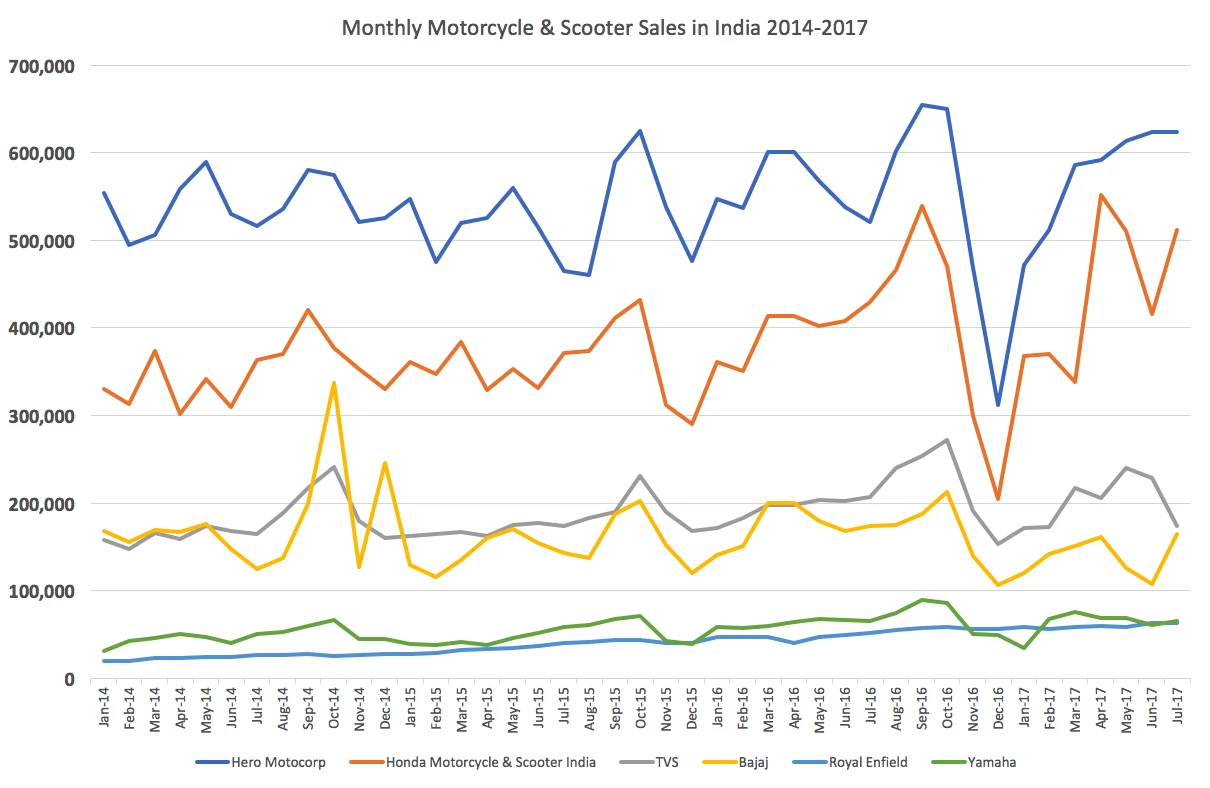

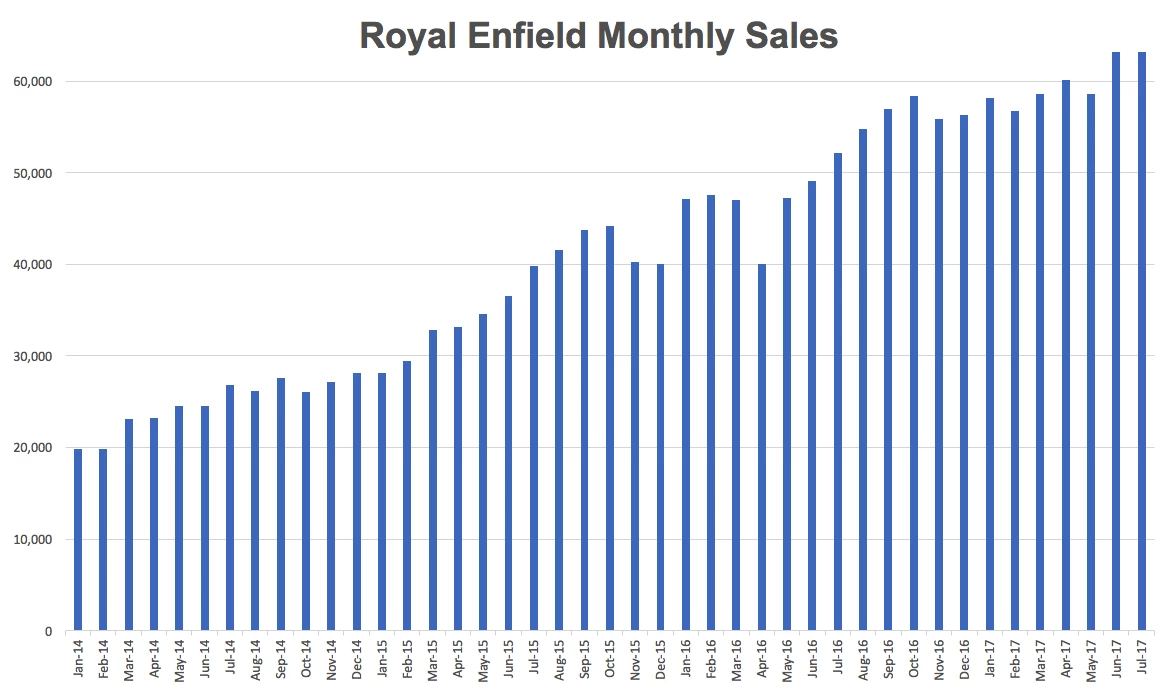

India's domestic motorcycle marketplace is currently comprised almost entirely of sub-125cc scooters and motorcycles, but as history has witnessed with other motorcycle markets of the last century, the larger capacity "luxury" classes take an increasing share as the market matures ... and that is just beginning to happen. The blue line at the bottom of the below chart is Royal Enfield – it shows four years of near linear growth.

Around 500,000 motorcycles are sold in America each year, and around 125,000 are sold in the United Kingdom. By comparison, India sold 17.59 million motorcycles in the 2016-2017 financial year – more every three days than are sold in the UK in a year, more every 11 days than are sold in the US in a year.

Most of those two-wheelers are of inconsequential capacity by western norms – nine of the top ten selling models in India last year had capacities of 100cc or 125cc with aspirational names such as the Splendor, Passion and Glamour. The only motorcycle in the top 10 with a capacity greater than 124cc is the bike directly below ... the Royal Enfield 350 Classic.

Royal Enfield's enduring relationship with India

The Royal Enfield name was first seen in India in 1895 as the rifle of the British Army, which had colonized India. When independence came to India in 1947, the Royal Enfield was the first motorcycle available in 1949, becoming the official motorcycle of the Indian Army and Police forces, with local production following in 1955.

As the only motorcycle of Indian manufacture for the next few decades, the company served as the primary supplier of motorcycles to India at a time when two-wheels offered the most cost-efficient and reliable way of covering distances in a vast land.

Returning 80 mpg and with legendary reliability in adverse conditions, Royal Enfield claimed a special place in India's national psyche. Not only had it become an Indian success story (the British parent company went broke), it had along the way become entwined with India's motorcycling culture. Royal Enfield is to India as Harley-Davidson is to America.

Indeed, though Harley-Davidson enthusiasts are loyal enough to tattoo their arms and chests with the company logo, they show nothing like the brand allegiance of Royal Enfield enthusiasts.

Half a century later, the Royal Enfield still dominates India's big bike (250cc plus) sales with monthly sales of more than 60,000 units a month.

The Royal Enfield model range is still comprised of 350cc and 500cc single cylinder motorcycles with more than a passing resemblance to the 1932 Bullet, yet four of every five bikes over 180cc sold each month in India are Royal Enfields.

Throughout it all, Enfield sales have continued to grow in the domestic market, topping 700,000 motorcycles in the last 12 months. By comparison, Harley-Davidson sells 250,000 units each year globally, KTM sells 200,000, BMW sells 150,000 motorcycles, while Triumph and Ducati sell 50,000 each – all of them together just match Royal Enfield's total output.

The most fascinating aspect though is the continued runaway levels of success of the brand in the Indian marketplace, where waiting periods of three months for most Royal Enfield models are commonplace across Indian dealerships. Next year the company plans to produce 900,000 motorcycles in an effort to meet demand.

All markets follow the leader

The dominance of Royal Enfield's retro design now appears to be shaping the entire marketplace, as heritage brands are being courted, partnered and created so that other manufacturers can compete with Royal Enfield.

Royal Enfield began making motorcycles in 1901 and its status as one of the oldest motorcycle marques is the main reason that other long standing marques have all partnered with, or been acquired by an Indian motorcycle maker in the last few years: Peugeot (since 1901), Triumph (since 1902), BSA (since 1903) and Husqvarna (since 1903).

Here follows the history of the new order as it has unfolded

Bajaj and KTM

The partnership between India's Bajaj and Austria's KTM is one of the great success stories of the motorcycle industry, having begun a decade ago in 2007 when Bajaj purchased a 14 percent stake in KTM. This enabled KTM to triple its annual production numbers from 65,000 in 2007 to 200,000 in 2017, and become the largest motorcycle manufacturer in Europe along the way.

Bajaj has now invested around $250 million in KTM and produces around 100,000 KTMs a year at its manufacturing facility in Chakan, near Pune. In turn, beyond KTM's core competency of building "race ready" performance motorcycles, it owns a number of highly relevant technology companies, such as renowned motorcycle suspension company WP, and aerospace manufacturer Pankl, which produces key components such as turbines and conrods for aircraft and high performance engines. The relationship provides access to an ecosystem of manufacturing competency.

Bajaj's philosophy of developing long-term relationships to achieve growth has been very successful, and Bajaj is also the Kawasaki distributor in India. Last month (July 2017), Bajaj went very close to purchasing the Ducati brand name from Lamborghini (in turn, a subsidiary of Volkswagen Group), but the deal failed at the eleventh hour for unknown reasons. Within weeks, it had found an alternative new partner of similar promise: Triumph.

Bajaj and Triumph

Esteemed British motorcycle manufacturer Triumph announced it would partner with India's Bajaj last week, with the aim of delivering a "range of outstanding mid–capacity motorcycles benefiting from the collective strengths of both companies." With similar existing sales numbers to KTM at the beginning of the Bajaj relationship, plus R&D resources capable of producing state-of-the-art motorcycles for enthusiasts, Triumph and Bajaj have the makings of an ideal and very rewarding partnership.

Bajaj and Husqvarna

Last month, Bajaj and KTM announced they would globally roll out a full range of Husqvarna motorcycles, another well-known European motorcycle brand name with an extraordinary heritage, having begun manufacturing motorcycles in 1903.

KTM acquired a long-term license agreement for the use of the Husqvarna brand from BMW in 2013 and the announced plans call for Husqvarna motorcycles to be manufactured in the same Indian plant (Chakan) as KTM, and distributed in equal numbers to KTM in the medium term.

The first planned Husqvarna models, the Vitpilen 401 (pictured above), Svartpilen 401 and the Vitpilen 701 will be produced by KTM in Austria, and launched in 2018. Later in the year, production of the Vitpilen 401 and Svartpilen 401, which share the KTM 390 Duke engine, will be transferred to Bajaj's Chakan factory.

KTM production in India is expected to exceed 100,000 units this year, and with Husqvarna production to be ramped up from 2018, that number of motorcycles produced from the KTM relationship is expected to double to 200,000 over the next few years.

Hence, in addition to the two million Bajaj motorcycles sold in 2016, the fourth largest Indian motorcycle manufacturer has leveraged its success developing two of its own brands (KTM and Husqvarna), and nurturing a non-equity partnership with Triumph.

TVS and BMW Motorrad

In 2013, the third-largest Indian motorcycle manufacturer, TVS, announced a strategic partnership with Germany's BMW Motorrad to design and build sub-500cc aspirational motorcycles under the BMW brand for both the Indian domestic and global markets. In 2016, TVS sold 2.48 million motorcycles in India, but had never produced a motorcycle larger than 250cc.

The new BMW G 310 R was announced in 2015, and is currently rolling out into developed countries under the BMW brand (see our first test of the bike), with production taking place at the TVS Hosur plant in Tamil Nadu. Production is still ramping up, with 4,772 units produced in 2016-2017 financial year, and 2,000 units produced last month.

Sales will begin in India next year once BMW has developed a more extensive dealership network, with more new models designed by BMW Motorrad and built by TVS to follow.

Mahindra and Peugeot

Mahindra & Mahindra is one of India's largest companies with annual revenues of US$13 billion. The company is India's largest producer of SUVs and utility vehicles and its subsidiaries include the world's largest tractor manufacturer. It has been working toward building a presence in the Indian motorcycle industry since 2008 with little success, though the last few years has seen an intensification of effort and expenditure that indicates that failure is not an option.

The company created Mahindra Racing and began racing in the World Motorcycle Championships in 2011, at first in the 125cc class, then in the Moto3 (250cc) class. In 2016, the team was supplying several satellite teams plus an official Peugeot team with motorcycles and experienced its first success with two Grand Prix wins.

Mahindra Two Wheelers, the eighth largest motorcycle manufacturer in India, acquired a controlling interest (51 percent) of Peugeot Motocycles in 2015. Peugeot claims to be the oldest motorcycle manufacturer in the world, though it's debatable whether the claim is technically accurate. Peugeot showed the motorcycle above at the 1898 Paris Exhibition, but did not actually begin manufacturing motorcycles until 1901, the same year that England's Royal Enfield and America's Indian began production.

Perhaps even more relevant to Mahindra's ambitions was the purchase in 2015 of the famous Italian design house Pininfarina for $185 million. Pininfarina's long-term relationship with Ferrari as its designer of choice over the last 70 years will enhance Mahindra's ability to create premium products.

Mahindra and BSA

In 2016, Mahindra & Mahindra acquired a controlling share in Classic Legends Private Limited (CLPL). Subsequently, in October 2016, Classic Legends acquired the rights and trademarks for the legendary British Motorcycle company BSA. Classic Legends paid just £3,399,600 (US$4,150,000) for the rights to resurrect one of the best known motorcycle brands in history, a company that was once the largest motorcycle manufacturer in the world.

Detailed plans for the marque are still unclear, but design of a range of 500cc to 750cc motorcycles is known to be underway in Italy and manufacturing facilities are being built in both France and India with a view to a brand launch in 2019. Mahindra has also confirmed that it has acquired the rights to the "Gold Star" brand, which was synonymous with BSA for many decades.

Mahindra and Jawa

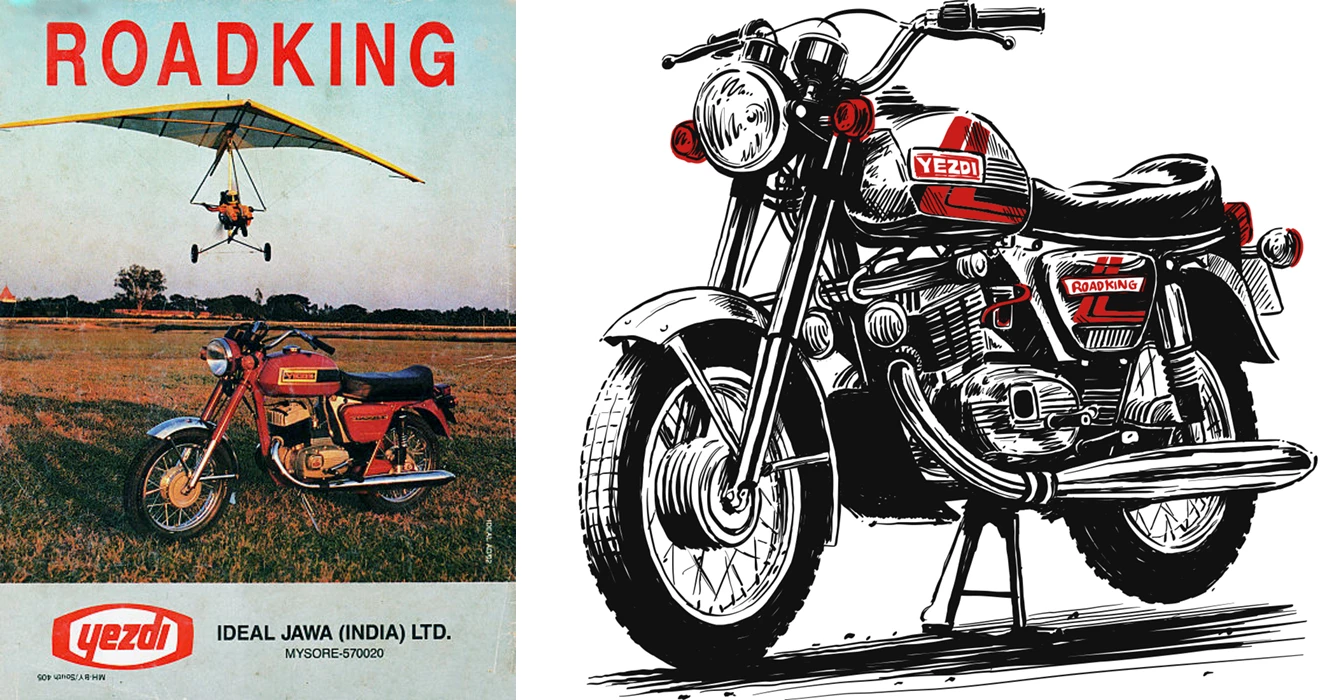

In the same 2016 time-frame as it acquired the rights to BSA, Mahindra subsidiary Classic Legends also acquired the Czech motorcycle manufacturer Jawa and, in a separate deal, the rights to the name Yezdi. Jawa motorcycles were sold in over 120 countries during the 1960s and 1970s, with the distinctive two-strokes enjoying a reputation for reliability that borders on legendary.

If you've never heard of a Yezdi, you're probably not alone if you live outside India. Jawa motorcycles were initially distributed in india by Ideal Jawa, but eventually were rebranded as Yezdi and the acquisition of both Jawa and Yezdi names indicates greater plans are afoot. Mahindra has already confirmed that a global dealership network is planned for both Jawa and BSA. The recent inauguration of a Yezdi web site aimed at the Indian market suggests the beloved Yezdi name will be used in India.