The emerging eVTOL air taxi market is drawing a lot of attention and an avalanche of funding money. Literally hundreds of companies are jostling for position as this nascent air mobility tech prepares for its prime time debut. But with renders, press releases and SPAC fundraising efforts flying as fast and frequently as these radically different new vehicles claim to, how do we know which ones are really taking off?

It's time for an eVTOL reality check – and that's exactly what consulting group SMG is trying to achieve with its Advanced Air Mobility Reality Index. SMG is not technology-focused; these guys don't care if a company is building an autonomous cargo machine, a medium-range winged tilt-rotor or a simple manned multicopter. They'll all find their place – what SMG tries to determine is simply this: how close is a given company to delivering their aircraft in volume?

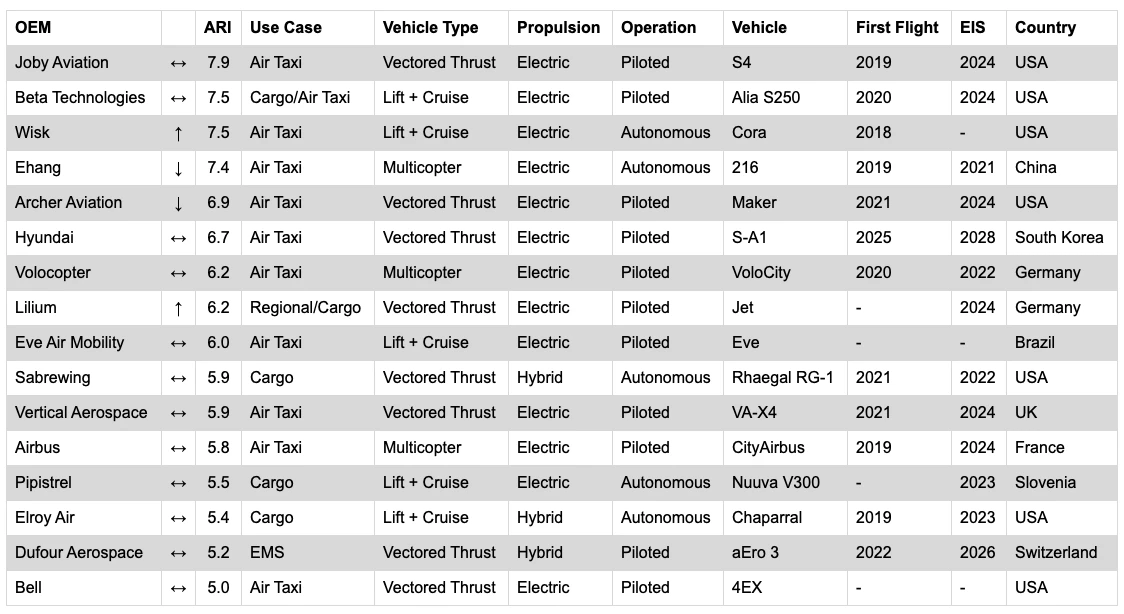

It's a very useful way to look at this exciting new space, and there are certainly some surprises on the list. Here's the current AAM Reality Index as it stands in early May 2021:

To talk through the thinking behind the index, as well as SMG's educated perspective on the top contenders, we caught up with SMG's Sergio Cecutta, the man behind the index, for an extended and very informative chat. What follows is an edited transcript.

Loz: Maybe let's let's start with this: what is SMG and what are you guys trying to do here?

Sergio Cecutta: Sure. We are a consulting firm that basically works on aerospace, defense, and automotive – especially what's called today, auto tech; that would be autonomy and electrification in cars. We work on the growth side of the house. Companies that want to launch new products, new markets, understand new geographies, pricing, supply chain, funding, M&A (mergers & acquisitions), that is what we do.

So, we are a group of of experienced executives. All of us are engineers, as well as people that have run large businesses in corporate America. Since 2017, with the launch of the first Uber Elevate summit and the white paper, we started to get interested in this market. That interest turned into getting to know more and more about this market. We work with airlines, OEMs, suppliers, as well as aftermarket companies.

And one of the things that we started thinking to ourselves was, well, this is an interesting market, there are a lot of entrants, how do we make heads and tails of all these entrants? That's the reason the Advanced Air Mobility Reality Index was created. So we created these tools for ourselves, and then we figured that, really, the industry was asking for these tools. This is the reason we publish them and we share them with industry.

So obviously, as a journalist, I get stacks of press releases from companies that are getting into this space. There are so many companies that want to be making eVTOLs, how do you evaluate these things when you first run across them?

We've decided to look at five different dimensions. One of our goals was to to keep it simple and to have something that was easy to compare. We wanted something that people can quickly understand, especially people from outside this space. It's not like conventional aerospace where people are familiar with the brands. I mean, I don't know anyone that doesn't know a Boeing or an Airbus, they might not know which one they're on, but they know that they're out there. In the eVTOL space there is a lack of legacy players, but an abundance of startups. And so we looked at five dimensions.

Number one is funding. So, how much funding does the company have? Do they have enough to complete specific milestones in their development? Do they have enough to build a prototype? Do they have enough to certify? Do they have enough to enter service?

The second piece is their team. Not just the CEO, but is the leadership team an aerospace leadership team? Are they familiar with the industry? Do they know what it means to certify an aircraft? Have they already run programs of this size, this complexity?

The third piece is technology readiness. Now, we wanted to stay away from judging the design of an aircraft for two simple reasons: one, the aircraft are very different from each other, and two, really no one knows all the details, unless you're inside the program. So we use what NASA uses – that is the technology readiness level (TRL) scale, it's basically a scale from one to nine that looks at the maturity of the technology. Anything less than six is not ready for prime time. TRL 6 is the first time that a prototype has been flown in the relevant environment – a full-size aircraft that has covered the entire flight envelope. So, it has taken off vertically, it has transitioned, it has flown and it has landed. TRL 9 would be the final product.

The next piece that comes along is certification. Do they understand the certification requirements? How far along are they? Certification is very important, for the simple reason that the rules for certifying these vehicles are brand new, and no one has done it before.

Last but not least, we look at production, and the reason we look at production is because the manufacturers of these vehicles are talking about thousands of vehicles. In aerospace, we don't make anything in the thousands. Take Airbus, they're starting to think at a rate of about 60 A320-family aircraft a month. That's what, about 700 aircraft a year, and that is a lot. But in the eVTOL market, people are talking about producing 900, 1,000, 1,500 a year. We've never heard of those kind of numbers. So, we wanted to see what's their capability? Can they make one? Can they make ten? Can they make a hundred? Can they make thousands?

We've applied weights for each of these dimensions. And, while I'm not going into the secret sauce of the calculations, basically all of these elements combine to create a number.

Last but not least, the index does not try to say who's going to be the winner. We don't know. The index is a current snapshot of where we see the race being at right now. It's a snapshot of how the different companies rank with respect to each other. Will it be different tomorrow? For sure. We published our latest update Monday, and I can tell you that I already have updates to that update! But again we'll wait for a little more information to come along. It is a very dynamic space.

So how often will you be updating this list?

The goal is to be monthly, we want to avoid having two- to three-month gaps, because there's always enough information. But at the same time, we don't want to bombard people with releases.

Certification, as you say, is a massive, massive challenge for any company that's trying to get into this space. The numbers that I've heard off the record for what a certification run is going to cost ... I've heard half a billion dollars, I've heard up to a billion dollars – just to get a single airframe certified. Because it's such a new space. The rules are not just new, as I understand they're still being decided upon as this process proceeds. So, you're looking for budgets around that level? What says to you that a company has enough money to do this?

Unfortunately, the devil is in the detail. The certification budget depends on two things: their supply chain strategy, and the type of vehicle they're trying to certify. So, you have heard correctly, for some of the most complex configurations, they're talking about a billion US dollars to get to certification. For some of the simpler ones, they're talking about a quarter to half a billion.

Now, the truth is, we need to understand the complexity of the configuration. For example, multicopters are less expensive to certify than more complex configurations like lift plus thrust, or vectored thrust configurations.

The other piece is the supply chain. So, if the company decides to go fully vertical, as in they will produce everything in-house, they need more money, because all the components need to conform and need to be certified, and all the burden will come back on that same company. If instead, they use a typical aerospace strategy for supply chain, as in to have risk-sharing partners, then each one of the partners will take a piece of the certification burden and the company will need less money.

So, unfortunately there is not one number that fits them all in. That is very important to understand.

Can you give me an example of a company that is sharing that risk in an appropriate way?

Well, for example, Honeywell is working as a risk-sharing partner with Vertical Aerospace, based in England. They're making a vectored thrust aircraft, and Honeywell is providing the avionics and the flight controls for this specific vehicle. In this case, when it comes to risk-sharing, for the certification of the avionics and flight controls, that onus will fall on Honeywell, and not the manufacturer. Therefore, the amount of funding needed to arrive to certification in this case might be lower than if someone was making the flight controls in-house.

And it's always good to have someone that can help. Any time you can retire risk, it's a good thing. It makes it more likely that the program will follow the schedule that you have in mind.

Okay, so just to be clear, you guys have no business relationship with any of the companies on this list, you're independent in that sense?

Correct.

OK, then let's discuss some of the contenders!

eHang

So when I first saw this list, eHang was on top of it. But in the latest version of the list they've moved down a couple of spaces. I was surprised to see them up on top given some of the news that came out lately. There was a short seller guy running around taking pictures of their facilities and chasing up their contracted customers and basically trying to discredit the organization. So, can you talk about what's happening with eHang in the context of the index here?

So, when it comes to the short seller ... without going into detail, claims like these need to be founded in proof. And usually what we see is that if there is an involvement from the SEC, that is the Securities and Exchange Commission in the US, then we worry about claims, but usually if the SEC doesn't get involved, it means that they do not consider the claims to be something that they have to worry about. You've seen the SEC step in, for example, with Nikola. We've seen it with other companies.

When it comes to eHang, they have a specific market in China. And right now if you look at these companies, there is really no alternative. Yes, Volocopter has announced that they will be working with Geely, one of the largest car manufacturers in the world and one of their investors, but at the same time, having a position in China is very important. And it's also a market that could be closed to outsiders. eHang does have a vehicle, and now they're actually expanding their portfolio to include other vehicles, and if you look at all of the dimensions and you calculate according to the numbers, you will see that they do come up in the top 10.

Do you guys see an easier path, perhaps, to certification in China?

Well, I don't know if it's easier, but it's going to be a specific path. Until now. China has always used or adopted regulations from either EASA or FAA, and in this type of vehicle, it could be that China will be more of a pioneer when it comes to certification. So, it could be a different set of rules. Speculating is pointless, because there are so many variables. But again, what matters is that the CAAC is creating its own rules, they're not waiting for FAA or EASA to finish with theirs.

Joby Aviation

Gotcha. So, top of your current list, and separated from the others by a bit of a margin there, is Joby Aviation. These guys were one of the first to get into this scene. What do you guys see when you look at that company?

Joby, they've been around since 2009, if I'm not mistaken, and they have developed multiple manned and unmanned aircraft. They have flown the entire envelope, and if you watch the video where they announced their SPAC, they have demonstrated that the vehicle is quiet. And that is one of the critical aspects for these vehicles; they need to be significantly quieter than the vehicles that operate today.

The other piece that's important is that they've defined a certification basis with the FAA. That basically means they have defined the list of requirements that they will have to meet for certification. Last but not least, they've obtained what's called MFR: military flight release. Basically it's a military airworthiness for their machine, and they share that only with one other company, Beta Aviation. In the industry, they're seen as the leading companies when it comes to these kind of vehicles.

Beta Technologies

And Beta Technologies with the Alia, that's second on your list there. They've just done a deal with UPS?

They've done a deal with UPS. They've done a deal with Blade. And as of yesterday they announced the reception of military airworthiness. There is a slight difference, because the military worthiness received by Joby was for the full envelope, but unmanned. Instead, Beta has received military airworthiness only for its airplane mode, not the vertical mode. But at the same time it is the first manned airworthiness in this sector. That means that the Air Force is confident enough to put one of their pilots in the seat, and start to understand what it will mean to have electric aviation be part of the future of their portfolio.

Wisk Aero

Right, okay. In third place you've got Wisk Aero, obviously an offshoot of Kitty Hawk, and they're operating primarily in New Zealand at the moment. What do you guys see when you look at Wisk?

So, Wisk has also been around for a long, long time, starting out with Kitty Hawk. Now they have a very strong partner on board in Boeing. It seems Boeing has chosen Wisk as their road to market. Right now they're flying the fifth generation of their vehicle, and they are getting ready, by the end of the year, to come up with the sixth generation, which is going to be basically the production-representative aircraft that they will go ahead and certify.

Lately, they have opened certification both in New Zealand, and in the US with the FAA. And last but not least, you've seen yesterday an order from Blade for 30 of their vehicles. Now, Wisk is going fully autonomous, and that could mean a longer certification time, as opposed to manned aircraft, but as of this time we really don't know what that means.

Archer

I guess it's hard to talk about Wisk without bringing up Archer as well, which comes two spots further down on your listing in fifth place. Archer's come in fairly late in the game with a lot of energy, a lot of money and perhaps from the sounds of things a bit of legal trouble in the form of that fight they're having with Wisk.

Yeah. I mean, as far as the legal fight, that's something for the legal system. But Archer does have an extremely talented group of individuals. They have put together the cream of the crop of the industry, and they are proceeding at a very good pace to bring these airplanes to market.

Now, one of the things that we don't do with the index is to consider any of the SPACs. Those have been announced, but the deals have not been closed. They haven't gone through the full scrutiny of the authorities, so when the deal will close you will see these companies trading publicly on a specific exchange. And that time has not arrived yet. For the three companies on our list that have announced SPACs, they all have spoken about the end of Q2, so probably it's going to be around the June time period where we'll see these deals close, and the cash will actually move into their coffers.

Right, so yes, a lot of the main players in this industry are starting to list via SPAC. From what I understand it's not a great deal for investors, compared to a traditional IPO, but there are a significant advantages to the companies. Can you share any perspective on that?

Well, I wouldn't say that it's bad for the investors. It is a different financial vehicle than an IPO. It allows longer term projections than an IPO. And so it's a good vehicle for this company, to have access to the type of capital needed to certify.

Aviation is a market that needs significant amounts of investment upfront, and then it takes a long time to recoup the investment. What we found is that SPACs meet this need for these companies to get funding, and at the same time allows them to tell a story that otherwise could not be told in an IPO. IPO is all about historical financials. The SPACs allow them to make projections to 2025, 26, and it lets them basically talk about their story as a company.

That's why it's been a vehicle of choice. What has happened is that there's been extreme exuberance in SPACs, not in this sector but in general, with hundreds of deals. And so the entire sector of SPACs as an investment vehicle is coming under scrutiny by the SEC in the US.

So you would not necessarily consider these things a worse deal for investors than an IPO?

It's a different financial instrument than an IPO.

Hyundai

Hyundai is an interesting case. Obviously that's a company with access to monstrous manufacturing capabilities, and its own source of capital, what do you guys see when you look at Hyundai?

When you look at the investment in these companies, we see a lot of strategic investors, investors that not only bring in capital, but they also bring expertise. For example, Toyota with Joby, or Daimler and Geely with Volocopter. In Hyundai's case, it has taken a strategy to actually go it on its own.

Car companies are seeing two trends conspiring against their automotive business: electrification that brings lower maintenance costs, and autonomy which one day might mean less cars are needed out there in the public. And so these companies are starting to think of themselves as mobility companies, providing a way for their customers to move. It could be a car, it could be a bus, could be a truck, or it could be an aircraft.

Hyundai has entered the market by creating their own division and hiring very good talent in their Urban Air Mobility division. In fact, it's run by the former NASA Aeronautics administrator, a guy that did a lot of great things at NASA.

So, when I first learned about Hyundai, and later about Joby's deal with Toyota, my first thought was: both these companies are leading the world in hydrogen fuel cells. Obviously, hydrogen offers a path to a much higher energy density than batteries, which could give eVTOLs much greater range and much quicker refueling stops. Neither of these companies has said anything in public about hydrogen, but since Japan and Korea are focusing so hard on a hydrogen economy, could this be a key advantage for these companies?

There is an interest around hydrogen from the aerospace industry worldwide. There are some companies in AAM that are betting on hydrogen. In Hyundai's case, I would say that they bring two key strategic advantages. Number one is the knowledge of what it takes to build products in the thousands, or even in the millions.

The other piece is their knowledge around batteries. Because, yes, while aerospace batteries are different than car batteries, they are building and working with them in volume. The Hyundai group is made of multiple brands, they have just announced the first two vehicles built on their new E-GMP platform, a dedicated electric platform that will spawn tens of models throughout their portfolios. And also, a lot of these companies are starting to look at solid-state batteries. That's another change that will come to this market and it's of interest to everyone, but we're not there yet.

Alakai Skai & hydrogen aircraft

As far as I can see your index doesn't include any hydrogen-specific aircraft. I'm thinking particularly about a company like Alakai Skai. Where would they fit on your list at the moment?

We have not looked at them. We're adding new entrants every time that we update the index. For the second release we've added Dufour and Archer, and we plan to add more in the future. So we just haven't got to everyone yet.

But the goal here is not to add everyone. If you look at the Vertical Flight Society, it's like the home of this industry. Mike Hirschberg and all of these guys have done an amazing job. They list over 430 projects from probably over 200 manufacturers. Our goal is not to go through 200 manufacturers at all. There is going to be a long tail of manufacturers that never get off the ground. We want to concentrate on the most promising companies, in order to bring more visibility to the sector.

Volocopter

Volocopter is another interesting company. Seventh on your list, I think. Very short-range vehicles – and obviously that doesn't really feature in your calculations here, but I think the sort of ranges they're talking about are 30 to 40 kilometers (19 to 25 miles) on a charge.

This is not a one-vehicle-fits-all market. There might be different vehicles that can cover different markets. Volocopter's strategy is for typical urban mobility missions. So, something that might not need the range of some of the other aircraft. It's also one of the few multicopters in the list. But they have agreed with EASA to a certification basis. They've been talking around the world to work with Geely in China and other companies. Daimler and Geely are their investors. So they're doing a lot of good moves. They're working on all of the aspects of their business.

Lilium

And Volocopter makes for an interesting comparison with Lilium. Because, as you say, Volocopter's honing in on a particular use case, which is, you know, one side of a city to another. They're starting off in Singapore, which is a very, very small geographical area to cover, and probably a great use case for a short-range multicopter that has no efficient cruise mode.

Lilium, on the other hand, is now talking much more in terms of regional, inter-city transport. Their aircraft, with its small-diameter electric fans, has a lower lift efficiency compared with the rest of the class, but it's low-drag and perhaps more efficient in winged flight, so they want to spend as little time as possible in vertical flight, and they're not that interested in short, cross-town trips. This is another company that's been public with their activities for a long time now, one of the early companies on the scene. They have a beautiful aircraft, and they've just revealed a seven-seater. What do you see when you look at Lilium?

So, Lilium is making a lot of progress. They have a really strong team across all of the disciplines. Production, certification, engineering, and they are taking all the right steps towards certification. What they have ahead of them is some work to complete the envelope expansion for their five-seaters and then for their seven-seaters. That's a very important goal for them, and it's what they'll be focusing on for the rest of the year.

eVTOLs need to demonstrate three main pieces; the ability to hover, going up and down vertically; the capability to fly horizontally, whether they have wings or not; and the transition between vertical flight and horizontal flight. Some of these companies have already completed the entire envelope. Some of these companies have completed pieces of the envelope, but not the entire envelope and it's very important for companies to complete engineering tests and flight tests in the entire envelope in order to validate that the vehicle has the performance they're expecting.

I guess that flight envelope will be pretty similar to a helicopter, right? Maybe some of them go a little faster at top speed, but they should be just as good at handling the low, slow stuff, right down to a stop.

There is a big difference: helicopters are extremely efficient machines in hover. eVTOLs are not meant to hover for extended periods of time. So, for an eVTOL, the hover is a very, very small part of the flight on its way to cruise. Helicopters are built for hovering for extended periods of time, like for example, if you need to look at something. Like a police helicopter that needs to hover and look at suspects. These vehicles can hover, but they're not made for extended hover times.

And that's where the multicopter designs lose range, because they have to hold themselves up on power the entire time with no wing lift. But, on the other hand, those guys have a potentially cheaper path to certification, as you say, because they don't have to do that complex transition maneuver between vertical and horizontal flight.

Again, we won't know what it means to certify these aircraft until some of them are certified. The first aircraft will open the door to the next ones.

Airbus and Bell

We probably shouldn't talk through the whole list, I'd be tickled pink but our poor readers have already probably fallen asleep. But I would like to bring up Airbus and Bell, obviously two very well-established aerospace companies, quite low down the list at the moment. Where are these guys lagging behind? What do you think's happening there?

Mmm. These are companies with enormous portfolios. And while they completely understand the importance of this new market, they have other parts of the business to take care of. In the case of Airbus, the effect of COVID on commercial aviation is definitely something that took their interest. They're developing a prototype of their CityAirbus, and they want to understand what this space means.

When it comes to Bell, they're competing for two military contracts, for the FLRAA and the FARA, and those are taking a significant amount of time. The FLRAA is the replacement for Blackhawks, so it's an enormous competition.

Recently, the CEO of Bell said something that was very interesting in an interview ($). He said, "am I worried about some of these guys (the other entrants in the air mobility industry) that have never certified an aircraft, worried that they're going to dominate the market? I'm not worried about that at all."

Bell is sitting on the sidelines, it wants to understand what it takes to certify these vehicles. It wants to see the technology mature. It wants to see batteries mature. And that is the approach of most of the legacy companies: it's cautious interest, but they're going to wait.

Interesting. Okay, in a more general sense we're starting to see dates like 2024, 2025 bandied about as the possible start of commercial services here and there. Do you think these timelines are realistic?

The timeline really depends on the length of time that the certification authorities will required in order to get there. So, I think at this point the answer is, yes, they can make it by 2024. But at the same time, we can't be completely sure, because certification is not in the hands of the manufacturers, it's in the hands of the regulatory bodies.

Do you think these things can get up and running without significant infrastructure on the ground, or is that going to have to be a big part of the rollout.

Well, if you if you look at the very beginning, I think the first Uber conference, you saw these skyports, that look like they're out of Star Wars, enormous. That was Uber just wanting to put out a vision.

I think many of these companies are starting with the understanding that the infrastructure that exists today, is where these companies will start operating. Blade operates helicopters in Pune, Mumbai, Sao Paolo and New York, and in their roadmap they'll transition to EVAs, or electric vertical aircraft. And the idea here is that they will replace the helicopters with these new vehicles. And they have Beta, with which they've signed an order, and now they have Wisk, with which they've signed another order.

And so the idea for a company like Blade is to operate between these locations where they already have these heliports. The infrastructure comes in when we want to expand, and, ultimately, if we want to get to the levels of, you know, having thousands of vehicles per city, we definitely need an infrastructure that's not there yet. But cities around the world are starting to work on it, with different levels of of speed and interest.

I wonder if you could comment as well on some of the projected trip pricing that we've been seeing over the last few years, saying that these vehicles are going to be about the cost of taking a ground-based Uber between between two points. Obviously that's vastly cheaper than helicopters, and that'll be a massive factor in widespread uptake.

If you look at the financial texts released by the companies that are doing SPACs, they have a lot more information. And getting to the cost of an Uber Pool/Uber X, that's farther out into the future. They need to have a lot of aircraft flying, they need to have autonomy, and then they can get to these levels. When they enter into service, it might be equivalent to the cost of Uber Black, so you could call it a limo service. The projections vary, but we hear about US$6 a mile at the beginning. But as the service grows, the goal is for the price to come down.

Okay, let's talk about safety. All I'm hearing from any of these companies is redundancy, and the odd ballistic parachute. So, everyone's running multiple separate battery packs, multiple flight controllers, and distributed propulsion that can keep you in the air even if you lose a prop or two.

But in the event of total failure, below a certain height, and it's not an insignificant height, about 120 meters (394 ft), you don't have time to pop a parachute. Are you aware of any innovation in this area, or is the redundancy concept going to be enough?

I mean, in aviation, we always say that we don't compete on safety. So, any and all of these vehicles will be certified by the authorities, with the same level of safety that you expect when getting on an airliner. So, when it comes to this, I would say, yes, safety is very important, but safety, it's something that everyone is working on.

Right, but are redundancy and parachutes the only solutions?

I think every company is looking at safety, according to the vehicle that they're designing, so I don't think that there is one solution. But, yes, in aerospace redundancy is very important because it allows you to continue to fly, even if something fails.

I guess with a fixed-wing plane you can try to land it unpowered. With a helicopter you can try to autorotate. There doesn't seem to be an equivalent sort of total failure measure for these for these things, and I was just wondering if you'd heard of anything that that's coming to fill that space.

What we know is that the cert authorities are working with all of these companies to make sure every one of the aircraft they certify is safe. I don't think that there's going to be one silver bullet that applies to all of them, it's going to be different for each one of the vehicles, but at the same time they're going to make sure that the public can be confident that getting on one of these vehicles, it's no different than getting on an airplane at the airport.

Well, it's been a very informative chat. Let's keep in touch as the list evolves. It's such an exciting space, the potential to transform the way we live and get around is enormous. I think people in general are fascinated by by this industry, I know I am, I just think it's super cool that we're finally going to get the Jetsons cars! It's going to change the way that cities look and work, and I've already got friends buying houses further out of town on the basis of future eVTOL fast commutes. Obviously, people are moving out of cities as a result of COVID, and lockdowns and I think that plays into the hands of these longer range air commuting companies. So very exciting times.

Technology's always exciting. I think eVTOLs are bringing back that excitement to aerospace that might have been lacking for some time, so I find it positive.

It's a good point, yeah, your regular air travel has been so similar for the last 60 years that there hasn't been much cause for people to get interested. But this stuff is pure sci-fi. When you first see a Lilium jet hovering around you're just like, oh, this is very different. This is new.

We thank Sergio Cecutta for his time and willingness to share.

Source: AAM Reality Index